Climate Change

Policy on climate change

Our Awareness of Climate ChangeThe concept of sustainable development was put forward in Our Common Future, the report submitted by the World Commission on Environment and Development (the Brundtland Commission) to the United Nations in 1987. As a result, climate change caused by global warming and its impacts was broadly recognized throughout the world as a major factor relating to environmental issues. In the early 1990s, the need to conclude international agreements on climate change countermeasures increased, and the United Nations Framework Convention on Climate Change was adopted at the United Nations Conference on Environment and Develop (known as The Earth Summit) held in Rio de Janeiro in 1992 with the objective of stabilizing the atmospheric concentrations of greenhouse gases.

Under the UN Framework Convention on Climate Change, the Conference of the Parties (COP) has been held annually since 1995. The Kyoto Protocol, which sets greenhouse gas emissions targets for developed countries, was adopted at COP3 in 1997. This was an extremely significant step as an international global warming countermeasure, since it imposes specific duties on individual countries to take action to reduce emissions.

Subsequently, the Paris Agreement was adopted at COP21, which was held in Paris in 2015. It seeks to pursue efforts to keep the global average temperature rise to 1.5°C while keeping it well below 2°C compared to before the Industrial Revolution, with agreement reached that each UN member establish its own greenhouse gas reduction targets.

One representative impact of climate change that has been measured to date is the increase in average temperatures. According to Meteorological Agency data, global average annual temperatures are rising at a rate of 0.75°C per century, and in Japan, the annual average temperature is increasing by 1.26°C per century.

There are concerns about the impact of climate change, which is thought to be the effect of global warming, and the impact of large-scale natural disasters on ecosystems around the world. In addition, the damage caused by large typhoons and torrential rains, which are thought to be the effects of climate change, has been occurring one after another. According to the Japan Meteorological Agency, the annual number of occurrences of precipitation of 50 mm or more per hour nationwide was about 226 times during the 10 years from 1976 to 1985, but about 334 times during the 10 years from 2011 to 2020.

As a result of these tangible effects of climate change as well as efforts to reinforce global frameworks concerning global warming and climate change exemplified by the Paris Agreement, climate change has been attracting increasing attention in recent years not just as something to be addressed by countries and governments, but also as a social responsibility to be fulfilled by the private sector.

Positioning of Climate Change by NMF and Basic PolicyBased on the idea that it is essential for our sustainable growth to realize sustainable society, we also believe our contribution to solving social issues through our business is in line with our fundamental philosophy of “securing stable profit over the medium to long term” and “steadily achieving growth in assets under management.” Consequently, it would contribute to improving our unitholder value. When undertaking specific initiatives, we have engaged in repeated discussions taking into consideration the impacts on NMF's business and performance and the expectations and interests of stakeholders, and we have identified ESG material issues (materiality) that are particularly important to us.

Based on Our Awareness of Climate Change set forth in (1) above, responses to climate change are an urgent management issue that NMF will face while undertaking sustainable business activities, and we have positioned it as a materiality issue.

For details on NMF's materiality issues, the materiality identification process, and the relationships among materiality issues and the SDGs, refer to the Materiality page.

Climate change involves medium- to long-term risks, and if we are unable to respond appropriately to those risks, there is a possibility that NMF will not be able to achieve steady growth of assets under management and that it will be difficult to achieve increases in unitholder value over the medium to long term.

On the other hand, we believe that climate change will present new business opportunities. If we are able to address these issues appropriately, this will lead to increases in the value of assets under management as well as higher unitholder value.

Based on this recognition, we aim to contribute to the transition to a low-carbon society and expand the profit opportunities, and while fully managing the physical and transition risks associated with climate change, it also uses greenhouse gases. We will continue to promote efforts such as emission reduction.

In July 2020, the asset management company to which NMF entrusts management of its assets expressed its support for the TCFD Recommendations and decided to join the TCFD Consortium, an organization of companies in Japan that support the TCFD Recommendations. The objectives are to promote dialogue with unitholders and other stakeholders and collaborate with them to achieve continuous improvement through expansion and enhancement of information disclosures relating to policies and initiatives regarding climate change.

The TCFD is the Task Force on Climate-related Financial Disclosures established by the Financial Stability Board (FSB) for the purpose of investigating climate change related disclosures and how financial institutions should respond. Climate change is a serious risk for the global economy, and the TCFD has announced recommendations urging companies and other organizations to ascertain and disclose information relating to governance, strategy, metrics and targets, and risk management.

The TCFD Consortium is an organization that was established with a view to encouraging concerted efforts by companies and financial institutions that support the TCFD and discussion of effective corporate disclosure and initiatives that link disclosed information to appropriate investment decisions on the part of financial institutions and other organizations.

(Disclosure Items Recommended by the TCFD)

| Disclosure Item | Disclosure Details |

|---|---|

| Governance | Organizational governance relating to climate-related risks and opportunities |

| Strategy | Actual and potential impacts from climate-related risks and opportunities on the organization's businesses, strategies, and financial planning |

| Risk management | The organization's climate-related risk identification, assessment, and management processes |

| Metrics and Targets | Metrics and targets used to assess and manage climate-related risks and opportunities |

NMF's Initiatives regarding the Disclosure Items Recommended by TCFD

GovernanceFor information regarding the implementation structures relating to sustainability (here and hereafter, including responses to climate change) of the asset management company to which NMF has entrusted operation of its assets, refer to the Policies and Management Structure page.

StrategyNMF has identified risks and opportunities relating to climate change risks that will affect it and has conducted scenario analysis to investigate the effects on business. In this series of investigation processes, we took into consideration the Green Growth Strategy Towards 2050 Carbon Neutrality based on Japan's 2050 Carbon Neutral Declaration.

Scenario Analysis AssumptionsNMF conducted scenario analysis using future climate predictions announced by various international organizations and other groups as the main information sources. The main information sources referenced by NMF are indicated below. Climate change risks can be broadly classified as transition risks and physical risks, and it is believed that the relationship between these two types of risks is one of interdependence and trade-offs.

| Climate Change Risks | Main Information Sources Referenced | |

|---|---|---|

| Transition risks | Risks arising from new regulations, tax systems, technologies, and so on introduced to create a decarbonized society | IEA (International Energy Agency) World Energy Outlook 2020 International Energy Agency (IEA), World Energy Outlook 2020 |

| Physical risks | Risks arising from climate change itself, such as changes in weather | Intergovernmental Panel on Climate Change (IPCC), Fifth Assessment Report (AR5) |

In light of the intent of the Paris Agreement, NMF set three patterns—a 4°C scenario, 2°C scenario, and 1.5°C scenario—as the assumed scenarios for scenario analysis. Overviews of each scenario are set forth below.

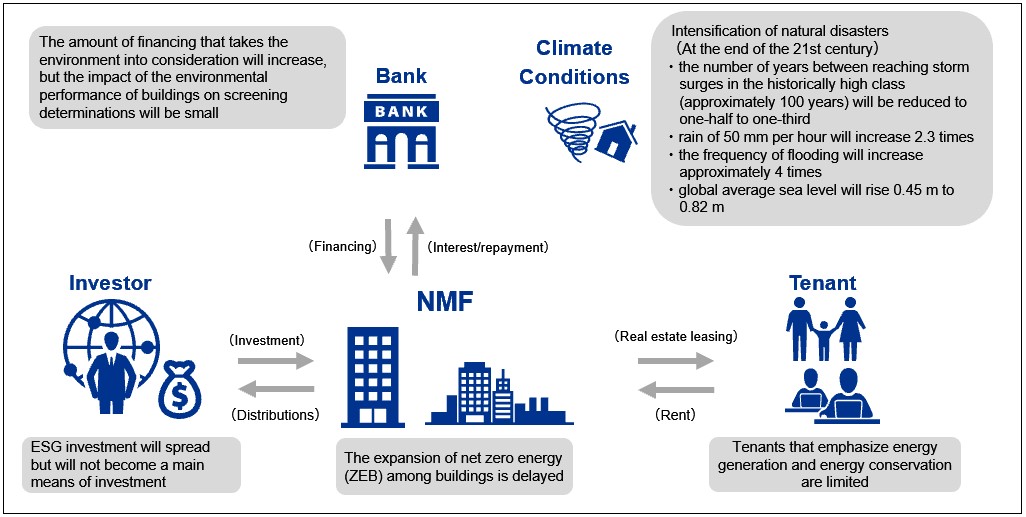

【4°C Scenario】

The 4°C Scenario assumes that more strict regulations, tax systems, and so on will not be introduced to create a decarbonized society and that greenhouse gas emissions will continue to increase. This scenario entails high physical risks and low transition risks.

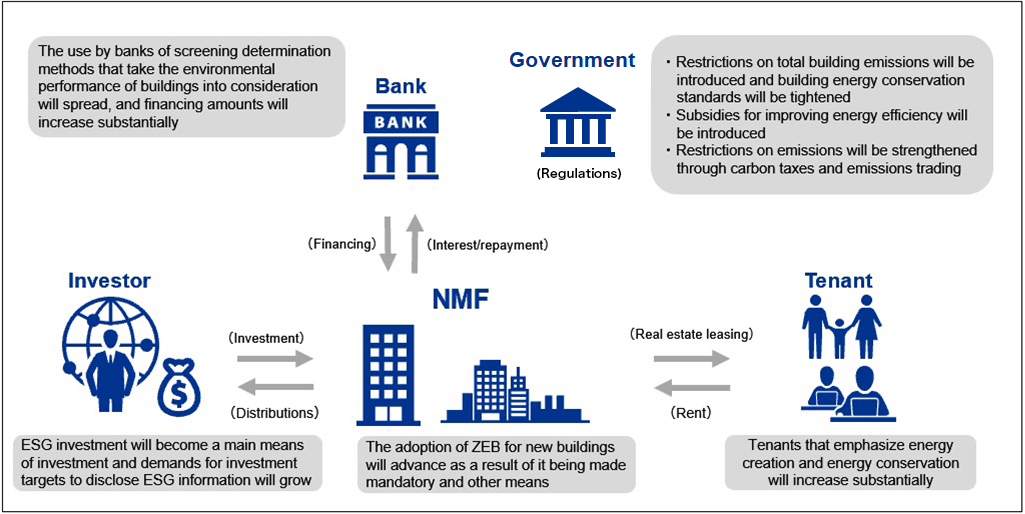

【2°C Scenario and 1.5°C Scenario】

The 1.5°C scenario assumes that greenhouse gas emissions will trend downward as a result of the adoption of more strict regulations, tax systems, and so on to achieve a decarbonized society. This scenario entails low physical risks and high transition risks.

The 2°C scenario is positioned between the 4°C scenario and the 1.5°C scenario and assumes that greenhouse gas emissions will be curtailed to some degree as a result of the adoption of more strict regulations, tax systems, and so on, similar to the 1.5°C scenario. This scenario entails low physical risks and high transition risks, but not to the same degree as the 1.5°C scenario.

NMF performs scenario analysis to identify the factors of climate change related risks and opportunities and summaries of the expected financial impacts from those factors as set forth in the table below.

| Category | Risk and Opportunity Factors | Financial impacts | Type | counter-measure | |

|---|---|---|---|---|---|

| Transition Risks | Policy | Costs for energy-generating and energy-conserving buildings decrease as a result of stricter regulations on total building carbon emissions and energy conservation standards and advances in ZEB (net zero energy building) technologies |

(1) Costs for retrofitting (modification of existing buildings to increase energy efficiency) will be incurred |

Risk |

・CO2 (intensity) reduction targets (40% reduction by 2030 compared with FY 2016) and monitoring and disclosure of progress ・Promotion of modification of existing buildings ・Promotion of green leases in cooperation with tenants, encouragement of energy conservation to tenants ・Introduction of renewable energy (including procurement of green electricity) ・Replacement of existing properties with and/or investment in properties with good environmental performance |

|

(2) Lower utility expenses as a result of adoption of ZEB |

Opportunity | ||||

| Introduction of carbon taxes, introduction of emissions trading systems | (3) Increased carbon tax burdens |

Risk | |||

(4) Costs for purchase of renewable energy credits will be incurred |

|||||

| Disclosure systems relating to building energy efficiency assessments expanded and made mandatory | (5) Certification and other costs will be incurred |

・Targets for acquisition of environmental certification (70% of our properties with Green Certification (3 Stars or Higher) by FY2030) and monitoring and disclosure of progress |

|||

| Markets | Changes in investment stances in conjunction with the increase of ESG investors | (6) Lower capital procurement costs as a result of green bonds, green loans, etc. |

Opportunity | ・Utilization of green finance such as green bonds |

|

| Changes in financing determination by banks in accordance with responsible banking principles | |||||

| Increase in companies that seek carbon neutrality | (7) Higher occupancy rates at energy-generating and energy-conserving buildings |

・Replacement of existing properties with and/or investment in properties with good environmental performance ・Promotion of modification of existing buildings ・Promotion of acquisition of environmental certification and energy saving rating ・Understanding new tenant needs through tenant satisfaction surveys, etc. |

|||

| Reputation | Selection of properties by companies and tenants with an emphasis on energy generation and energy conservation | ||||

| Selection of properties by companies and tenants with an emphasis on disaster preparedness | (8) Lower occupancy rates at buildings with high disaster risks |

Risk |

・New investment phase: Investigation of risks of climate change (e.g., flood risk) in due diligence process ・Property management phase: Regular assessment of sustainability risks including risks of climate change (e.g., flood risk) ・Hard disaster measures (e.g., installation of water-stopping plates and/or a heating system that melts snow on the property to make it safe to walk and soft disaster measures (e.g., inland flood risk alert-notification system, business continuity plan, evacuation drills) ・Insurance contracts covering disaster risks |

||

| Physical Risks | Acute | Increases in intense rain, storms and flooding, landslides, and high tides |

(9) Loss of sales opportunities due to building flooding (10) Increase in repair costs and casualty insurance premiums due to building flooding |

||

| Chronic | Sea level rise | ||||

NMF verified the scope of the financial impacts from the identified risks and pportunities for each of the three scenario patterns described above. Impacts were verified at 2030 (medium-term outlook) and 2050 (long-term outlook) for each scenario. A summary of the results is set forth in the table below.

This verification made reference to scenarios announced by the IEA, IPCC, and other organizations, objective forecast data announced by other third-party specialized organizations, and other data available at the time, and involved qualitative and quantitative verification based on the status of the NMF's asset holdings, but the known risks entail uncertainties, and unknown risks and other factors are inherent, and consequently, there is no guarantee of the accuracy or safety of that information.

*Pale red and blue indicate a minor impact, and deep red and blue indicate a major

| Category | Financial impacts | Type | Scope of Financial Impact Amount | |||||||

|---|---|---|---|---|---|---|---|---|---|---|

| 4℃ | 2℃ | 1.5℃ | ||||||||

| 2030 (Mid) |

2050 (Long) |

2030 (Mid) |

2050 (Long) |

2030 (Mid) |

2050 (Long) |

|||||

| Transition Risks | Policy | ① | Retrofitting expenses | Risk | ||||||

| ② | Lower utility expenses as a result of ZEB | Opportunity | ||||||||

| ③ | Increased carbon tax burdens | Risk | ||||||||

| ④ | Costs for purchase of renewable energy credits will be incurred | Risk | ||||||||

| ⑤ | Certification and other costs will be incurred | Risk | ||||||||

| ⑥ | Lower capital procurement costs as a result of green bonds, green loans, etc. | Opportunity | ||||||||

| ⑦ | Higher occupancy rates at energy-generating and energy-conserving buildings | Opportunity | ||||||||

| Reputation | ⑧ | Lower occupancy rates at buildings with high disaster risks | Risk | |||||||

| Physical Risks | Acute※ | ⑨ | Loss of sales opportunities due to building flooding | Risk | ||||||

| ⑩ | Increase in repair costs and casualty insurance premiums due to building flooding | Risk | ||||||||

*The effects of chronic physical risks are likely to manifest after 2050, so they are excluded from the investigation of financial Impact amounts.

Risk ManagementThe risk management systems relating to sustainability of the asset management company to which NMF has entrusted operation of its assets are as set forth below.

At the time of investment decisionWhen making new investments in assets under management, the Investment Committee makes investment decisions in the due diligence process taking into consideration various investigations of climate change related risks. Specifically, with respect to the possibility of flooding and inundation of a target property, the inundation level and inundation history are investigated and confirmed using various hazard maps and the history of hydraulic engineering work implementation is also investigated and confirmed. In addition, the presence of environmental and energy-conserving facilities including acquisition of environmental certification, the status of business continuity planning, and other factors are confirmed.

During operationThe Sustainability Promotion Committee performs management and monitoring of overall risks relating to sustainability including climate change risks. Specifically, the status of implementation of energy-conservation measures to achieve greenhouse gas (GHG) emissions reduction targets (see (4) Metrics and Targets below for details) and the status of GHG reductions based on such implementation are monitored for each property, and this information is visualized to analyze the factors of increases or decreases in GHG emissions, and necessary countermeasures are investigated as needed. In addition, sustainability and risk assessment sheets are prepared for each property and the likelihood of climate change risks and other risks occurring is evaluated. These evaluations are conducted for a certain proportion of owned properties each year in accordance with a rotation of approximately five years for all properties. All sustainability initiatives, including climate change risk, are promoted based on the management and supervision of the Chief Executive Officer (Director) for Sustainability Promotion.

Metrics and TargetsNMF is aware that solving environmental problems exemplified by climate change is an important management issue within its sustainable business and its business strategies for achieving sustainable business. Based on this understanding, NMF is investing in lower environmental impact buildings, taking measures to increase the efficiency of energy usage and reduce GHG emissions through the implementation of environmental and energy conservation measures at owned properties, and seeks to establish a low environmental impact portfolio.

Making owned properties greenerRaise the ratio of properties acquired green certification (with three stars or more or equivalent to) to 70% by 2030.

| ※ | Green certification (with three stars or more or equivalent to) refers to DBJ Green Building Certification (three stars or more) or BELS Certification (three stars or more), or CASBEE for Real Estate (B+ or higher) |

|---|---|

| ※ | The figure is calculated based on the floor area of our properties excluding land. |

| ※ | For actual results to KPI, please referhere. |

Key Performance Indicator (KPI)

Achieve 40% reduction in greenhouse gas (GHG) emissions per floor area (intensity) from our portfolio by 2030 compared with the 2016 level.

(Midium-term goal: 34% reduction by 2025)

For actual results to KPI, please referhere.

Solar Power Generation FacilitiesWe are utilizing renewable energy by installing solar power generation panels on the rooftops of logistics facilities.

(FY2021 actual results)

| Number of properties | Annual output |

|---|---|

| 12物件 | 12,784,436 kWh |

| (note) | For properties acquired or sold during the period, the holding period is counted. |

|---|

-

- Energy Saving via a Switchover to LED Lighting

We are promoting a switchover to LED lighting at our properties to reduce energy consumption. -

- Energy Saving via the Renewal of Air-Conditioning Facilities

We are engaging in the renewal of air-conditioning facilities at our properties to reduce energy consumption. -

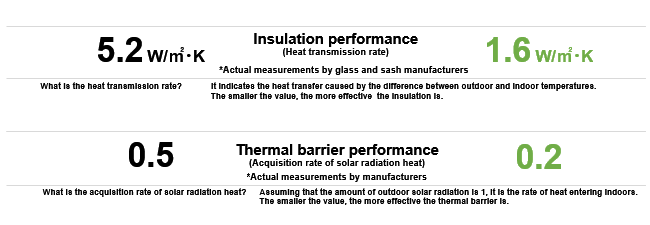

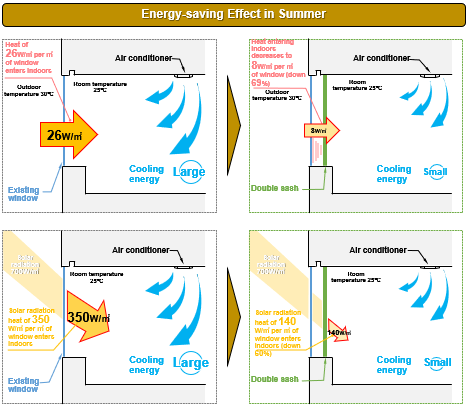

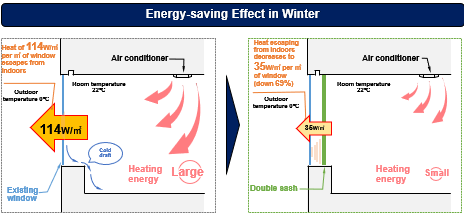

- Energy Saving via installing double sash

We are installing double sash to improve heat insulation and reduce the air conditioning energy required to keep the room temperature constant to reduce energy consumption. -

A System for Making It Easier to Check Energy Consumption (PMO Series)

Tenant Engagement Program -

On top of using smart meters and Building and Energy Management Systems (BEMS), NMF cooperates with tenants to promote initiatives for the environment. Properties leased under the PREMIUM MIDSIZE OFFICE (PMO) brand are furnished with tablet terminals that make it easier to check the status of energy consumption, with the aim of ensuring that NMF and tenant companies share an acute awareness of the need to pursue eco-friendly operations and reduce environmental burdens.

- Use of Electricity by Biomass Power Generation

Some of the electricity used by our properties is generated by biomass power which has a low environmental impact.

(Of the electricity used at PMO Shibakoen, PMO Ginza Hatchome, and NRE Yotsubashi Building from September 1, 2019 to March 31, 2020, about 198 Mwh is generated by biomass power.) -

- Expanding Greenery

We are proactively planting grasses and trees on the rooftops of our properties while striving to allocate larger spaces to greenery in the course of facility renovation. -

- Countermeasures against Flooding

Flood prevention barriers are in place at such facilities as the NRE Tennozu Building and the Sagamihara Tana Logistics Center to protect them from surges attributable to high tides and heavy rainfalls. -

- Countermeasures against Heavy Snowfalls

In Sapporo, Hokkaido—the northernmost prefecture in Japan—our properties are equipped with road heating systems to lessen the inconvenience of heavy snowfalls. Moreover, we have improved facilities to prevent the accumulation of snow near the roof edges in order to ensure that passers-by are protected from the sudden heavy falls from above. -

・Eliminates “cold drafts” from air cooled by the window surface flowing at foot level

・Reduces condensation that occurs around windows such as with existing glass/aluminum sash windows and air conditioning outlets

・Creates room spaces where the indoor temperature does not fluctuate much and there is little temperature difference between the window area and the center of the room

・Shortens the time for heating up, and improves sound insulation, etc.

Collaboration with Tenants

Based on an understanding that real property operation that takes into consideration global environmental issues will lead to stable operations over the medium to long term, NMF is collaborating with tenants in owned properties and entering into green lease agreements to address global environmental issues including reducing energy and water use as well as reduction and proper disposal of waste throughout the entire business supply chain.

Green Lease Clauses

Standard lease contracts proposed by NMF include the following clauses aimed at ensuring that NMF and tenants work together to reduce environmental burdens.

・Collaboration in the implementation of energy- and water-saving measures and waste reduction efforts to improve environmental performance and acquire relevant external certifications

・Information sharing pertaining to status and goals with regard to energy consumption and other environmental performance indicators

<An example of a green lease scheme>

Under this scheme, NMF and its tenants agreed to share expenses for investment in energy-saving facility upgrades (i.e., a switchover to LED lighting)

・NRE Yotsubashi Building

・SORA Shin-Osaka 21

・Sagamihara Tana Logistics Center

Replacement of Power Companies

NMF is engaged in the selection of power companies from a broad range of candidates, including Power Producer and Supplier (PPS) companies inaugurated following the liberalization of Japan's electricity market . For each candidate, NMF gives due consideration to such factors as their cost competitiveness and supply stability as well as CO2 emission coefficients attributable to their energy source mixes.

Adaption to Climate Change

We are proactively expanding greenery at our properties to curb rises in temperatures and reduce energy consumption. Also, we are implementing a number of countermeasures to secure resilience against damage attributable to natural disasters arising from climate change.