Materiality

ESG Materiality Issues Identified by NMF

Based on the idea that it is essential for our sustainable growth to realize sustainable society, we also believe our contribution to solving social issues through our business is in line with our fundamental philosophy of “securing stable profit over the medium to long term” and “steadily achieving growth in assets under management. Consequently, it would contribute to improve our unitholder value. In order to take specific sustainable initiatives, we have identified ESG materiality issues in consideration of expectations from our stakeholders as well as the impact on our business and performance.

Information

■Review of Materialities

In January 2020, NMF has reviewed its ESG materiality issues.

| ① | Addition of “Countering water resources” to its ESG materiality issues |

|---|---|

| ② | Formulation of KPI target to each materiality issues (Review of KPI target regarding “Greening the investment portfolio” and “Countering climate change”) |

<Principal changes>

| ・ | KPI target property specified in “Greening the investment portfolio” has been changed to property obtained green certification (with three stars or more or equivalent to) from properties obtained green certification (without evaluation level criteria) previously targeted. Therefore, KPI target has focused more on quality. |

|---|---|

| ・ | KPI target specified in “Countering climate change” has been raised to -40.0% from -25.0% (compared with 2016 level). |

| ・ | Addition of “Countering water resources” to its ESG materiality issues and setting quantitative target. |

| ・ | Setting KPI and (a part of) KPI target on Social and Governance materiality issues. |

Please refer to KPI Actual Results Management Sheet(19.3KB) ![]()

| Materiality, Policy and Target | Supporting SDGs | ||||

|---|---|---|---|---|---|

| Enviroment E  |

Raising the proportion of “green” properties in our investment portfolio |

|

|||

| Target | ・Raise the ratio of properties acquired green certification (with three stars or more or equivalent to) to 70% by 2030 | ||||

| KPI |

・Ratio of green certification (with three stars or more or equivalent to) ※

・Ratio of Green Certification

|

||||

| Reported Location | Raising the Proportion of “Green” Properties in Our Portfolio | ||||

| Countering climate change |

|

||||

| Target | ・Achieve carbon neutrality by 2050. ・Achieve 40% reduction in greenhouse gas (GHG) emissions per floor area (intensity) from our portfolio by 2030 compared with the 2016 level. (Midium-term goal:Achieve 34% reduction by 2025) | ||||

| KPI | ・GHG emissions per floor area (intensity) | ||||

| Reported Location | Environmental Measures/Counting Climate Change | ||||

| Countering water resources |

|

||||

| Target | ・Achieve 10% reduction in water use per floor area (intensity) in our portfolio by 2030 compared with the 2016 level. | ||||

| KPI | ・Water use per floor area (intensity) | ||||

| Reported Location | Environmental Measures/Preserving Water Resources | ||||

| Society S  |

Ensuring the safety and security of tenants and improving user comfort |

|

|||

| Target | ・Improve tenant satisfaction by conducting a regular survey of tenants' satisfaction, by carrying out property renewal and renovation aimed at accommodating diversifying social needs, by enhancing the content of tenant assistance services. | ||||

| KPI | ・Customer satisfaction survey results ※Scheduled to be implemented on a sector-by-sector basis from FY 2020 |

||||

| Reported Location | Social Responsibility/Ensuring the Safety and Security of Tenants and Improving User Comfort |

||||

| Creating a workplace environment in which everyone is treated fairly and empowered to find his/her job rewarding |

|

||||

| Target | ・Enhance employee satisfaction via the creation of a sound working environment that ensures impartial evaluation, provides fair compensation, respects for fundamental rights and allows everyone to find his/her job rewarding. | ||||

| KPI | ・Average number of paid holidays taken(Target : 18days per year or more) ・Employee satisfaction survey results | ||||

| Reported Location | ESG Management (Asset Management Company website) | ||||

| Human resource development and talent management |

|

||||

| Target | ・Help our human resources improve their capabilities by providing them with periodic training and by encouraging them to engage in self-directed studies and acquire job-related certification | ||||

| KPI | ・Actual attendance results of employee training (Training hours per employee) ・Number of employees qualified or certified | ||||

| Reported Location | ESG Management (Asset Management Company website) FIDUCIARY DUTY (Asset Management Company website) |

||||

| Governance G  |

Strengthening corporate governance |

|

|||

| Target | ・Establish an effective sustainability promotion system through appropriate operation of PDCA cycle as well as a governance system which ensures impartiality and diversity of the directors. ・Promote investment management that prioritizes the unitholders' interest by aligning the interests of the unitholders, NMF and the Asset Management Company by introducing asset management fees linked to management performance. ・Aim to improve management performance through appropriate management based on the market research function of the Asset Management Company and selective investment backed by our own valuation method at the time of acquisition. | ||||

| KPI | ・NMF's ① Outside director ratio ② Female director ratio ③ Board of directors' meeting attendance ratio ・External evaluation of the sustainability promotion system | ||||

| Reported Location |

Governance/Governance of the Investment Corporation Policies and Management Structure Investment Management Structure Prioritizing Unitholders' Interest |

||||

| Establishment of an effective internal control system |

|

||||

| Target | ・Ensure legal compliance through raising awareness of compliance. ・Prevent risks to the soundness of management and business continuity through appropriate risk management such as elimination of conflicts of interest in transactions with interested parties. ・Ensure the effectiveness of internal control process through internal audits. | ||||

| KPI |

・Compliance training attendance rate(Target:100%) ・Risk assessments frequency(Target: once a year) ・BCP training frequency(Target: once a year) ・Safety drill frequency utilizing safety confirmation system(Target: 4 times a year) ・Internal audit frequency(Target: once an year) |

||||

| Reported Location |

Governance/Compliance Governance/Risk Management |

||||

| Stakeholder engagement and timely and appropriate information disclosure |

|

||||

| Target | ・Build solid relationships with and win the trust of all stakeholders by engaging in the timely, appropriate and proactive disclosure of financial/non-financial information and by maintaining constructive dialogue | ||||

| KPI |

・Number of IR meetings ・ESG rating assessment |

||||

| Reported Location |

Stakeholder Engagement Disclosure Policy International Initiatives and Certifications |

||||

Identifying Process on Materiality Issues

Process 1:Selection of Issues to Be Considered

We have selected issues of particular concern in terms of securing NMF’s sustainable growth from among a broad range of environmental, social and governance (ESG) issues. This selection was made in reference to various guidelines, such as SASB(Note1) Standards and GRI Guidelines (Note 2), United Nations SDGs(Note 3), and evaluation criteria specified by ESG rating agencies, including MSCI and Sustainalytics, as well as the status of initiatives undertaken by our peers in the same industry.

| (Note 1) | The Sustainability Accounting Standards Board: A U.S.-based non-profit organization aimed at helping businesses identify industry-specific materiality issues that could affect the judgment of rational investors and engaging in the development of standards for sustainability-related information disclosure |

|---|---|

| (Note 2) | The GRI Guidelines: International guidelines concerning sustainability reporting formulated by GRI (Global Reporting Initiative) which is an official body of the UNEP as well as a non-profit organization whose mission is to create and disseminate a sustainability report. |

| (Note 3) | Sustainable Development Goals: Adopted at a United Nations Summit in September 2015, SDGs comprise 17 goals and 169 targets for international initiatives to be undertaken to achieve United Nations’ 2030 agenda for sustainable development. |

<SDGs 17 Goals>

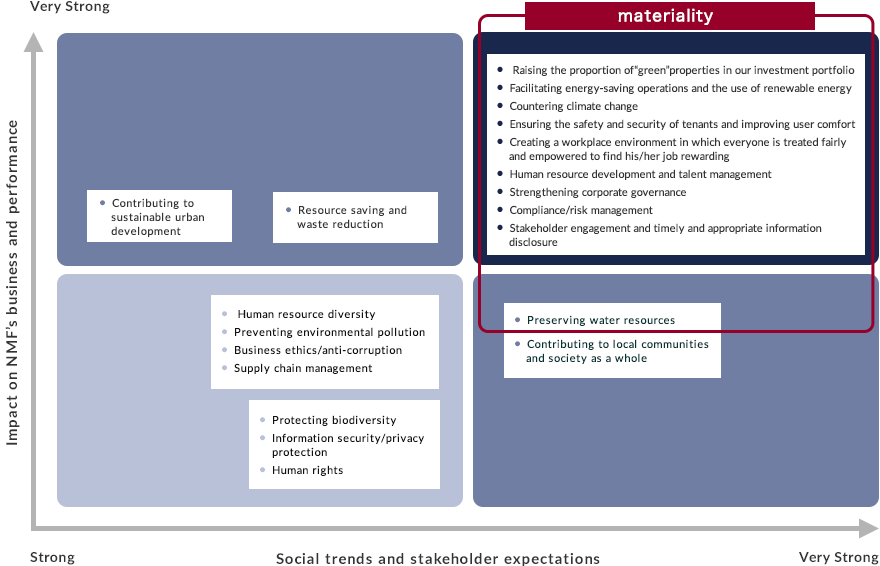

Process 2:Determining Priorities and Preparing a Materiality Matrix

We have determined priorities among the selected issues in line with their materiality by assessing their impact on NMF’s business and performance on various fronts, including its corporate philosophies, financial results and business plans. In the course of this process, we have also examined the issues from the perspectives of a variety of stakeholders within and outside the Nomura Real Estate Group. Each issue has thus been prioritized in light of its materiality to NMF’s sustainable growth from two aspects—the opportunity arising from it and the risk associated with it—with its positioning being indicated in NMF’s materiality matrix.

Process 3:Discussion for Approval on Identifying NMF’s Materiality Issues in the Investment Committee

Having determined their priorities, we have discussed these issues at the Sustainability Promotion Committee and officially positioned them as NMF’s materiality issues associated with sustainability after obtaining the approval of the Investment Committee, which serves as the highest decision making body.

<Materiality Matrix>