Policies and Management Structure

NMF's Approach to Sustainability

Based on the recognition that it is essential for our sustainable growth to realize a sustainable society, we believe our contribution to solving social issues through our business is in line with our fundamental philosophy of “securing stable profit over the medium to long term” and “steadily achieving growth in assets under management.” Consequently, it would contribute to improving our unitholder value.

With this in mind, alongside its asset management company, Nomura Asset Management Company Co., Ltd., NMF has carried out asset management that gives due consideration to ESG issues since its founding. In January 2019, we set goals or KPIs for ESG issues of particular importance (hereinafter referred to as “materiality”) and are promoting efforts to achieve the goals. Furthermore, in January 2020, we added materiality items and an upward revision of the target levels.

<Net Zero by 2050>

We recognize that “countering climate change” is of especially high importance among our materiality issues.

We believe that successful transition to a decarbonized society through achieving net zero greenhouse gas (GHG) emissions will eventually have a big impact on our medium- to long-term performance. Based on this idea, in October 2022, we set the goal of achieving net zero by 2050. Toward achieving that goal, we have been working to systematically reduce GHG emissions to the minimum so that our absolute emissions of GHG will become closer to zero. We are doing this by, for example, actively introducing energy-saving facilities and electricity generated from renewable energy sources for properties that we own.

We will continue to actively promote our sustainability initiatives based on the policies, targets and KPIs set for each materiality issue, as well as promoting bidirectional communication and working together with our unitholders, tenants, employees, supply chains, local communities and other stakeholders through our ESG disclosures.

Shuhei Yoshida

Executive Director

Sustainability Policies and Systems

- 1.Efforts to save energy and create energy We will strive to introduce technologies/facilities that contribute to save and/or create energy while proactively promoting efficient use of energy in real estate management.

- 2.Efforts to save resources and reduce waste We will strive to implement water saving and waste reduction (3Rs of reduce, reuse and recycle) for effective utilization of resources required in business activities.

- 3.Efforts for safety and security as well as improvement of the level of customer satisfaction We will strive to improve the level of customer satisfaction by promoting disaster prevention/BCP measures for the safety and security of our clients including tenant companies or facility users, and through other means.

- 4.Efforts to develop in-house systems and educate executives and employees We will not only fully enforce compliance but also develop in-house systems to promote our initiatives based on this policy, educate executives and employees, and conduct activities to raise awareness.

- 5.Collaboration with outside stakeholders We will strive to collaborate with stakeholders including our business partners such as property management companies, our clients such as tenant companies and facility users, and local communities in order to practice initiatives based on this policy.

- 6.Information disclosure to investors, etc. We will strive to proactively disclose information on the status of activities related to ESG to stakeholders such as investors.

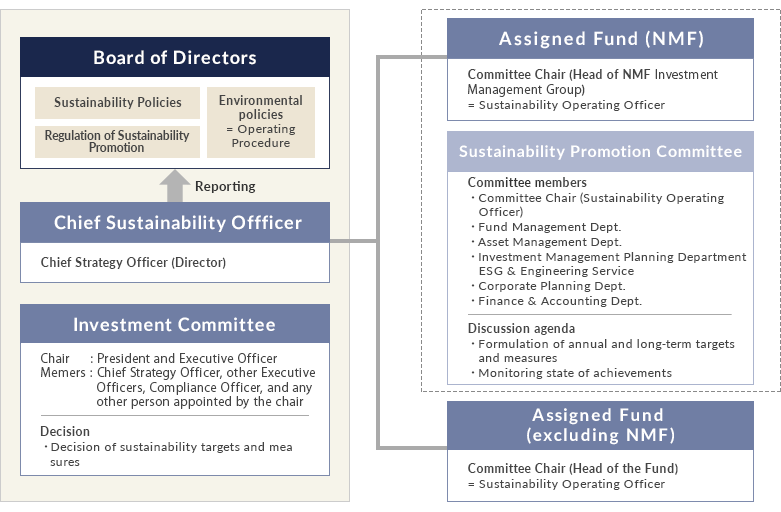

Sustainability Promotion Structure

Nomura Real Estate Asset Management Co., Ltd. (NREAM), an asset management company for NMF, has in place the following structure to promote initiatives under its Sustainability Policy in a constant and organized manner.

- (1)Board of Directors The Board of Directors formulates and revises the Sustainability Policy, sustainability promotion rules and other in-house policies and rules. Based on the sustainability promotion rules, the Board of Directors receives reports on the performance of initiatives related to sustainability throughout the year at least once a year from the Chief Sustainability Officer. The Board of Directors continually carries out monitoring of the initiatives related to sustainability based on those reports.

- (2)Chief Sustainability Officer The Chief Strategy Officer (Director), a member of the Investment Committee, is appointed as the Chief Sustainability Officer who designates funds that focus heavily on the promotion of sustainability from among the funds managed by the Asset Management Company. (NMF falls under the category of designated funds.) The Chief Sustainability Officer is involved in decision-making at the Investment Committee as the chief officer for sustainability and reports to the Board of Directors at least once a year based on the sustainability promotion rules.

- (3)Sustainability Operating Officer The Head of NMF Investment Management Group who controls NMF’s investments is appointed as the Sustainability Operating Officer. As the person responsible for the execution of sustainability promotion, the Sustainability Operating Officer convenes the Sustainability Promotion Committee, submits matters for discussion and reports to the Investment Committee.

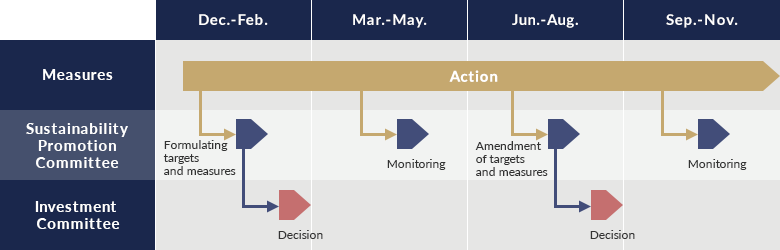

- (4)Investment Committee The Investment Committee is the decision-making body concerning NMF’s investments. It is chaired by the President and Executive Officer and is comprised of members including the Chief Strategy Officer and other Executive Officers. Based on the sustainability promotion rules, the Investment Committee deliberates on and determines targets, measures and other matters regarding NMF’s sustainability at least twice a year.

- (5)Sustainability Promotion Committee The Sustainability Promotion Committee is a body responsible for setting sustainability targets, measures and other matters, making recommendations and conducting monitoring (including risk management). It is chaired by the Sustainability Operating Officer and is comprised of members including the ESG & Engineering Service and heads of departments related to the NMF’s investments. The Committee is convened at least four times a year in accordance with the sustainability promotion rules.

- (6)ESG & Engineering Service The ESG & Engineering Service supports overall operations concerning the promotion of ESG considerations by the Asset Management Company and NMF based on the Sustainability Policy.

<Sustainability Promotion Structure>

<Annual Schedule>

-

Environmental Management System (EMS)

NMF became the first J-REIT to be certified and registered for “EcoAction 21” Program.

<Scope of Certification and Registration>

investment and management of office buildings and residential properties

-

Sustainability Promotion Manuals

Nomura Real Estate Asset Management Co., Ltd. (NREAM) formulated sustainability promotion manuals to provide basic policies with regard to and clarify procedures for its sustainability promotion initiatives, including those aimed at constantly monitoring and reducing the volume of energy and water consumption and greenhouse gas and waste emissions as well as those aimed at promoting green procurement through external collaboration. Through the distribution of these manuals, NREAM is striving to enhance the effectiveness of its sustainability initiatives.

<Overview of Sustainability Promotion Manuals>

| Titles | Content |

|---|---|

| Manuals for energy saving, GHG reduction, water saving and waste reduction |

・

Basic policies for the constant monitoring of and achieving ongoing reductions in consumption and emission volumes ・ Procedures for the monitoring, management and analysis of consumption and emission volumes and reporting to the Sustainability Promotion Committee |

| Green procurement manual |

・

Additional criteria to be assessed in the course of product and service procurement (energy-saving potential, vendors’ efforts to reduce the use of substances leading to environmental pollution, product durability and recyclability and other factors associated with environmental load reduction) ・ Additional criteria to be assessed in the course of the selection and evaluation of suppliers based on their involvement in sustainability initiatives (sustainability promotion structures, collaboration with environmental load reduction, etc.) |

Sustainability Risk Assessments

Our assets under management are subject to periodic sustainability risk assessments.

Whenever assessment results reveal a critical sustainability risk, in-house specialists charged with assessments propose improvement measures at the Sustainability Promotion Committee. In this way, we are ensuring that any sustainability risk is properly identified, monitored and addressed.

Sustainability Risk Assessments are carried out in rotation for about 5 years for all properties.

Training for Officers and Employees

We aim to empower our officers and employees to play greater roles in sustainability promotion and help raise their sustainability awareness, to this end providing them with special training. At least once a year, these individuals attend training sessions designed to call their attention to the importance of sustainability, address the latest trends in sustainability initiatives and brief them on the status of NMF’s sustainability measures and targets and the progress it has made. These training sessions thus help attendees stay acutely aware of and properly updated about various sustainability issues.