Materiality

ESG Materiality Issues Identified by NMF

At NMF, we recognize that realizing a sustainable society is essential for our sustainable growth. Based on such recognition, we believe that our contribution to solving social issues through our business is in line with our fundamental philosophy of “securing stable profit over the medium to long term” and “steadily achieving growth in assets under management,” ultimately helping to improve our unitholder value. In order to engage in specific sustainability initiatives, we engaged in repeated discussions in consideration of the expectations and interests of our stakeholders as well as the impact on our business and performance, and identified ESG issues (materiality) that are particularly important for us as shown below.

Please refer to KPI Actual Results Management Sheet(19.7KB) ![]()

This table can be scrolled sideways.

| Materiality, Policy and Target | Supporting SDGs | ||||

|---|---|---|---|---|---|

| Enviroment E  |

Raising the proportion of “green” properties in our investment portfolio |

|

|||

| Target | Raise the ratio of properties acquired green certification (with three stars or more or equivalent to) to70% by 2030 | ||||

| KPI |

・Ratio of green certification (with three stars or more or equivalent to) ※ ・Ratio of Green Certification

|

||||

| Reported Location | Raising the Proportion of “Green” Properties in Our Portfolio | ||||

| Countering climate change |

|

||||

| Target | ・Achieve net zero greenhouse gas (GHG) emissions by 2050 ・Achieve 80% reduction in greenhouse gas (GHG) emissions by 2030 (compared with the 2019 level) | ||||

| KPI | ・Greenhouse gas (GHG) emissions | ||||

| Reported Location | Environmental Measures/Counting Climate Change | ||||

| Countering water resources |

|

||||

| Target | ・Achieve 10% reduction in water use per floor area (intensity) in our portfolio by 2030 compared with the 2016 level. | ||||

| KPI | ・Water use per floor area (intensity) | ||||

| Reported Location | Environmental Measures/Preserving Water Resources | ||||

| Society S  |

Maintaining safety and dignity |

|

|||

| Policy and Target | Maintain safety and dignity through preparation against natural disasters, etc. (resilience), measures for children and the falling birthrate and aging population, realization of diversity and inclusion, and respect for human rights | ||||

| KPI | ・Utilization of disaster alert systems (Development status); installation of disaster kits in warehouses, elevators, etc. (Number of properties installing such kits and installation rate); installation of damp proof barriers for properties with high flood damage risk (Number of properties installing such barriers and installation rate) ・Participation in "Dining Room for Children" events in collaboration with tenants of GEMS, etc. (Number of events, number of participating tenants, and number of provided meals) ・Diverse talent composition at the Asset Management Company (Background, etc. of fund management members) ・Provision of residential space to foreigners (Number and proportion of residential units for foreigners); posting of notices in multiple languages in common areas of residential properties (Number of units responding and response rate) ・Installation of universal toilets and toilets for persons with disabilities (Number and proportion of properties installing such toilets) | ||||

| Reported Location | Social Responsibility/Safety and Dignity | ||||

| Realizing physical and mental health |

|

||||

| Policy and Target | Realize physical and mental health through a healthy and safe life and work style (health & safety) and a comfortable and highly convenient environment (wellness) | ||||

| KPI | ・Invitation of blood donation events (Number of properties holding events and number of participants) ・Promotion of flexible work styles at the Asset Management Company (Paid leave acquisition rate, etc.) ・Installation of delivery boxes (Number of properties installing delivery boxes and installation rate) ・Tenant satisfaction assessment survey (Percentage of "satisfied" and "somewhat satisfied" in overall satisfaction) | ||||

| Reported Location | Social Responsibility/Physical and Mental Health | ||||

| Realizing an affluent economy |

|

||||

| Policy and Target | Realize an affluent economy through talent empowerment, enhancement of productivity, and revitalization of regional economies and industry (innovation) | ||||

| KPI | ・Implementation of property manager (PM) commendation programs (Date of program implementation, award-winning cases) ・Enhancement of training programs, encouragement of acquisition of qualifications, and promotion of job rotation at the Asset Management Company (Training hours per employee and outline of training, status of employees with qualifications) ・Utilization of recycled goods (Implemented areas, CO2 reduction amount) ・Collection of clothing at residential facilities (Collection volume, CO2 reduction amount) | ||||

| Reported Location | Social Responsibility/Affluent Economy | ||||

| Forming attractive communities |

|

||||

| Policy and Target | Form attractive communities through formation and revitalization of community attractions and cultures (identity), restoration and formation of local communities, and easy-to-move environments (mobility) | ||||

| KPI | ・Holding of regional invigoration events at the GEMS series, etc. (Number of prefectures where events were held, number of participating tenants, number of used foodstuffs) ・Holdings of exchange events and tenant gathering seminars at owned properties (Number of events and seminars, number of participating companies) ・Introduction of shared mobility (Total travel distance, time and CO2 emissions amount reduced through use) | ||||

| Reported Location | Social Responsibility/Attractive Communities | ||||

| Governance G  |

Strengthening corporate governance |

|

|||

| Target | ・Establish an effective sustainability promotion system through appropriate operation of PDCA cycle as well as a governance system which ensures impartiality and diversity of the directors. ・Promote investment management that prioritizes the unitholders' interest by aligning the interests of the unitholders, NMF and the Asset Management Company by introducing asset management fees linked to management performance. ・Aim to improve management performance through appropriate management based on the market research function of the Asset Management Company and selective investment backed by our own valuation method at the time of acquisition. | ||||

| KPI | ・NMF's ① Outside director ratio ② Female director ratio ③ Board of directors' meeting attendance ratio ・External evaluation of the sustainability promotion system |

||||

| Reported Location |

Governance/Governance of the Investment Corporation Policies and Management Structure Investment Management Structure Prioritizing Unitholders' Interest |

||||

| Establishment of an effective internal control system |

|

||||

| Target | ・Ensure legal compliance through raising awareness of compliance. ・Prevent risks to the soundness of management and business continuity through appropriate risk management such as elimination of conflicts of interest in transactions with interested parties. ・Ensure the effectiveness of internal control process through internal audits. | ||||

| KPI |

・Compliance training attendance rate(Target:100%) ・Risk assessments frequency(Target: once a year) ・BCP training frequency(Target: once a year) ・Safety drill frequency utilizing safety confirmation system(Target: 4 times a year) ・Internal audit frequency(Target: once an year) |

||||

| Reported Location |

Governance/Compliance Governance/Risk Management |

||||

| Stakeholder engagement and timely and appropriate information disclosure |

|

||||

| Target | ・Build solid relationships with and win the trust of all stakeholders by engaging in the timely, appropriate and proactive disclosure of financial/non-financial information and by maintaining constructive dialogue | ||||

| KPI |

・Number of IR meetings ・ESG rating assessment |

||||

| Reported Location |

Stakeholder Engagement Disclosure Policy International Initiatives and Certifications |

||||

Identifying Process on Materiality Issues

Process 1:Selection of Issues to Be Considered

We have selected issues of particular concern in terms of securing NMF’s sustainable growth from among a broad range of environmental, social and governance (ESG) issues. This selection was made in reference to various guidelines, such as SASB(Note1) Standards and GRI Guidelines (Note 2), United Nations SDGs(Note 3), and evaluation criteria specified by ESG rating agencies, including MSCI and Sustainalytics, as well as the status of initiatives undertaken by our peers in the same industry.

- (Note 1) The Sustainability Accounting Standards Board:

A U.S.-based non-profit organization aimed at helping businesses identify industry-specific materiality issues that could affect the judgment of rational investors and engaging in the development of standards for sustainability-related information disclosure - (Note 2) The GRI Guidelines:

International guidelines concerning sustainability reporting formulated by GRI (Global Reporting Initiative) which is an official body of the UNEP as well as a non-profit organization whose mission is to create and disseminate a sustainability report. - (Note 3) Sustainable Development Goals:

Adopted at a United Nations Summit in September 2015, SDGs comprise 17 goals and 169 targets for international initiatives to be undertaken to achieve United Nations’ 2030 agenda for sustainable development.

<SDGs 17 Goals>

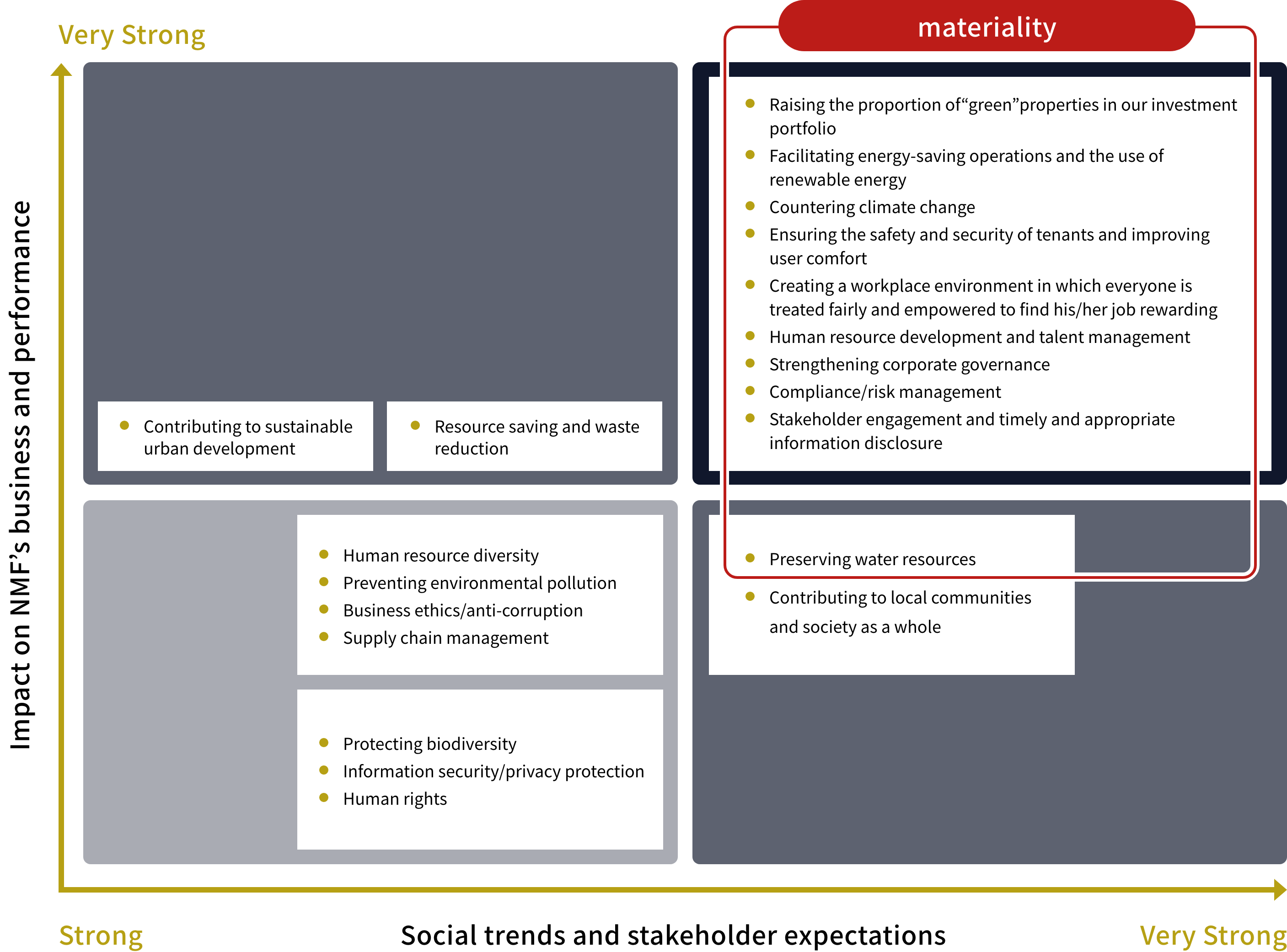

Process 2:Determining Priorities and Preparing a Materiality Matrix

We have determined priorities among the selected issues in line with their materiality by assessing their impact on NMF’s business and performance on various fronts, including its corporate philosophies, financial results and business plans. In the course of this process, we have also examined the issues from the perspectives of a variety of stakeholders within and outside the Nomura Real Estate Group. Each issue has thus been prioritized in light of its materiality to NMF’s sustainable growth from two aspects—the opportunity arising from it and the risk associated with it—with its positioning being indicated in NMF’s materiality matrix.

Process 3:Discussion for Approval on Identifying NMF’s Materiality Issues in the Investment Committee

Having determined their priorities, we have discussed these issues at the Sustainability Promotion Committee and officially positioned them as NMF’s materiality issues associated with sustainability after obtaining the approval of the Investment Committee, which serves as the highest decision making body.

<Materiality Matrix>

To further strengthen initiatives in the Society (S) field, we considered fundamental initiatives for solving social issues that can only be implemented by real estate owners and revised our materiality issues.

See below for the identification process and other details.