Policy on climate change

Our Awareness of Climate Change

The concept of sustainable development was put forward in Our Common Future, the report submitted by the World Commission on Environment and Development (the Brundtland Commission) to the United Nations in 1987. As a result, climate change caused by global warming and its impacts was broadly recognized throughout the world as a major factor relating to environmental issues. In the early 1990s, the need to conclude international agreements on climate change countermeasures increased, and the United Nations Framework Convention on Climate Change was adopted at the United Nations Conference on Environment and Develop (known as The Earth Summit) held in Rio de Janeiro in 1992 with the objective of stabilizing the atmospheric concentrations of greenhouse gases.

Under the UN Framework Convention on Climate Change, the Conference of the Parties (COP) has been held annually since 1995. The Kyoto Protocol, which sets greenhouse gas emissions targets for developed countries, was adopted at COP3 in 1997. This was an extremely significant step as an international global warming countermeasure, since it imposes specific duties on individual countries to take action to reduce emissions.

Subsequently, the Paris Agreement was adopted at COP21, which was held in Paris in 2015. It seeks to pursue efforts to keep the global average temperature rise to 1.5°C while keeping it well below 2°C compared to before the Industrial Revolution, with agreement reached that each UN member establish its own greenhouse gas reduction targets.

One representative impact of climate change that has been measured to date is the increase in average temperatures. According to Meteorological Agency data, global average annual temperatures are rising at a rate of 0.75°C per century, and in Japan, the annual average temperature is increasing by 1.26°C per century.

There are concerns about the impact of climate change, which is thought to be the effect of global warming, and the impact of large-scale natural disasters on ecosystems around the world. In addition, the damage caused by large typhoons and torrential rains, which are thought to be the effects of climate change, has been occurring one after another. According to the Japan Meteorological Agency, the annual number of occurrences of precipitation of 50 mm or more per hour nationwide was about 226 times during the 10 years from 1976 to 1985, but about 334 times during the 10 years from 2011 to 2020.

As a result of these tangible effects of climate change as well as efforts to reinforce global frameworks concerning global warming and climate change exemplified by the Paris Agreement, climate change has been attracting increasing attention in recent years not just as something to be addressed by countries and governments, but also as a social responsibility to be fulfilled by the private sector.

Positioning of Climate Change by NMF and Basic Policy

Based on the idea that it is essential for our sustainable growth to realize sustainable society, we also believe our contribution to solving social issues through our business is in line with our fundamental philosophy of “securing stable profit over the medium to long term” and “steadily achieving growth in assets under management.” Consequently, it would contribute to improving our unitholder value. When undertaking specific initiatives, we have engaged in repeated discussions taking into consideration the impacts on NMF's business and performance and the expectations and interests of stakeholders, and we have identified ESG material issues (materiality) that are particularly important to us.

Based on Our Awareness of Climate Change set forth in (1) above, responses to climate change are an urgent management issue that NMF will face while undertaking sustainable business activities, and we have positioned it as a materiality issue.

For details on NMF's materiality issues, the materiality identification process, and the relationships among materiality issues and the SDGs, refer to the Materiality page.

Climate change involves medium- to long-term risks, and if we are unable to respond appropriately to those risks, there is a possibility that NMF will not be able to achieve steady growth of assets under management and that it will be difficult to achieve increases in unitholder value over the medium to long term.

On the other hand, we believe that climate change will present new business opportunities. If we are able to address these issues appropriately, this will lead to increases in the value of assets under management as well as higher unitholder value.

Based on this recognition, we aim to contribute to the transition to a low-carbon society and expand the profit opportunities, and while fully managing the physical and transition risks associated with climate change, it also uses greenhouse gases. We will continue to promote efforts such as emission reduction.

Expression of Support for TCFD Recommendations

In July 2020, the asset management company to which NMF entrusts management of its assets expressed its support for the TCFD Recommendations and decided to join the TCFD Consortium, an organization of companies in Japan that support the TCFD Recommendations. The objectives are to promote dialogue with unitholders and other stakeholders and collaborate with them to achieve continuous improvement through expansion and enhancement of information disclosures relating to policies and initiatives regarding climate change.

The TCFD is the Task Force on Climate-related Financial Disclosures established by the Financial Stability Board (FSB) for the purpose of investigating climate change related disclosures and how financial institutions should respond. Climate change is a serious risk for the global economy, and the TCFD has announced recommendations urging companies and other organizations to ascertain and disclose information relating to governance, strategy, metrics and targets, and risk management.

The TCFD Consortium is an organization that was established with a view to encouraging concerted efforts by companies and financial institutions that support the TCFD and discussion of effective corporate disclosure and initiatives that link disclosed information to appropriate investment decisions on the part of financial institutions and other organizations.

Disclosure based on TCFD Recommendations

NMF expressed support for TCFD in 2019 and joined the TCFD Consortium to promote risk analyses, risk management and initiatives related to climate change, and facilitate TCFD-based information disclosures.

This table can be scrolled sideways.

| Item | Main details |

|---|---|

| Governance |

|

| Strategy |

|

| Risk Management |

|

| Metrics and Targets |

|

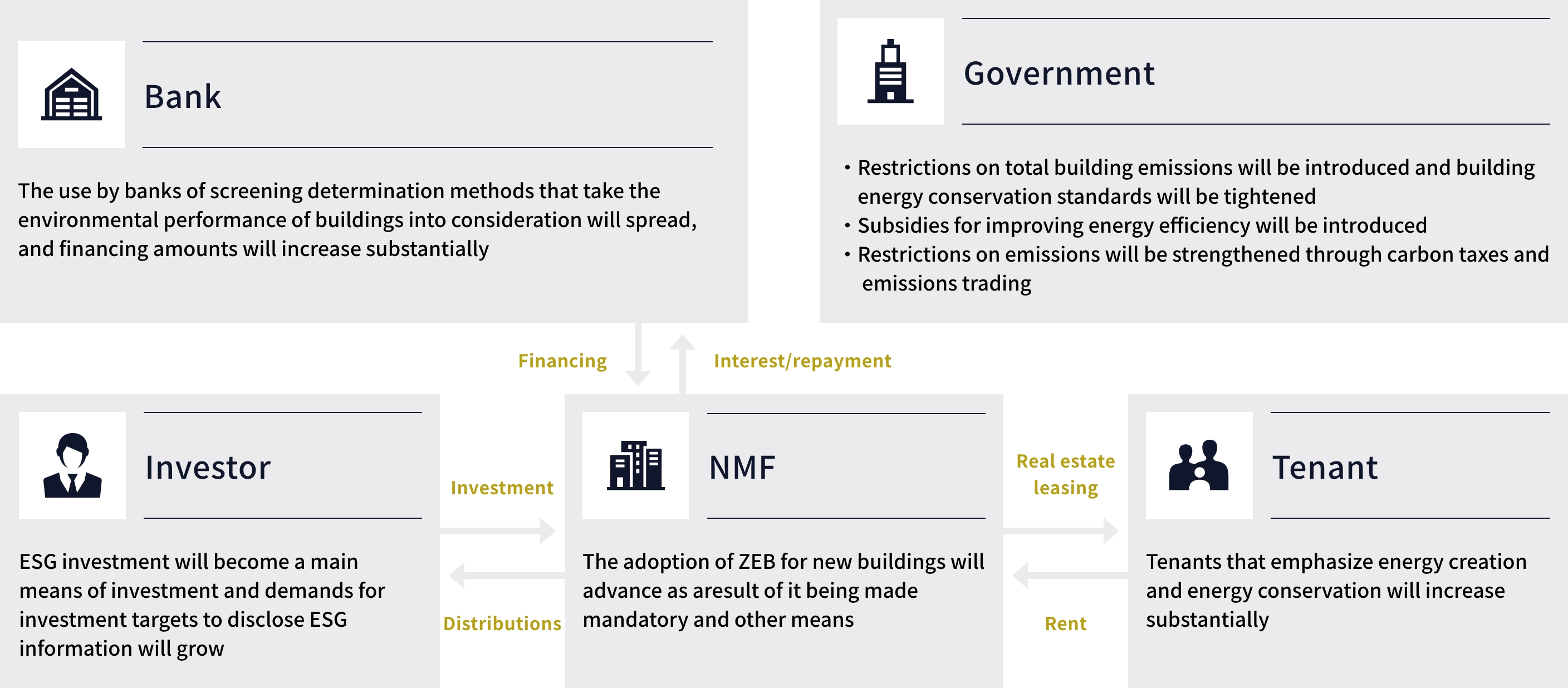

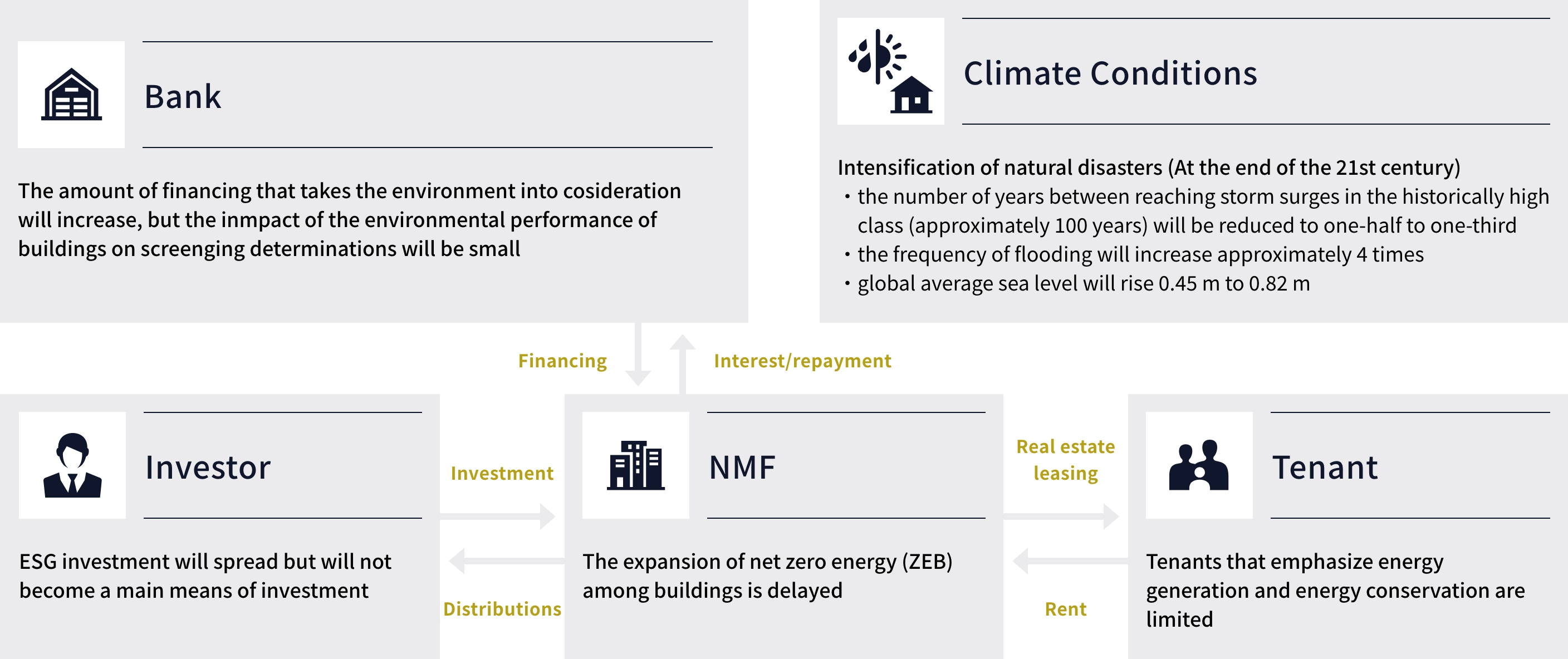

Strategy:Scenario Analysis

Scenario Analysis Assumptions

NMF conducted scenario analysis using future climate predictions announced by various international organizations and other groups as the main information sources. The main information sources referenced by NMF are indicated below. Climate change risks can be broadly classified as transition risks and physical risks, and it is believed that the relationship between these two types of risks is one of interdependence and trade-offs.

This table can be scrolled sideways.

| Climate Change Risks | Main Information Sources Referenced | |

|---|---|---|

| Transition risks | Risks arising from new regulations, tax systems, technologies, and so on introduced to create a decarbonized society | IEA (International Energy Agency) World Energy Outlook 2023 International Energy Agency (IEA), World Energy Outlook 2023 |

| Physical risks | Risks arising from climate change itself, such as changes in weather | Intergovernmental Panel on Climate Change (IPCC), Fifth Assessment Report (AR6) |

In light of the intent of the Paris Agreement, NMF set three patterns—a 4°C scenario, 2°C scenario, and 1.5°C scenario—as the assumed scenarios for scenario analysis. Overviews of each scenario are set forth below.

2°C Scenario and 1.5°C Scenario

The 1.5°C scenario assumes that greenhouse gas emissions will trend downward as a result of the adoption of more strict regulations, tax systems, and so on to achieve a decarbonized society. This scenario entails low physical risks and high transition risks.

The 2°C scenario is positioned between the 4°C scenario and the 1.5°C scenario and assumes that greenhouse gas emissions will be curtailed to some degree as a result of the adoption of more strict regulations, tax systems, and so on, similar to the 1.5°C scenario. This scenario entails low physical risks and high transition risks, but not to the same degree as the 1.5°C scenario.

4°C Scenario

The 4°C Scenario assumes that more strict regulations, tax systems, and so on will not be introduced to create a decarbonized society and that greenhouse gas emissions will continue to increase. This scenario entails high physical risks and low transition risks.

Verification of Financial Impact Amounts Based on Scenario Analysis

NMF verified the scope of the financial impacts from the identified risks and pportunities for each of the three scenario patterns described above. Impacts were verified at 2030 (medium-term outlook) and 2050 (long-term outlook) for each scenario. A summary of the results is set forth in the table below.

This verification made reference to scenarios announced by the IEA, IPCC, and other organizations, objective forecast data announced by other third-party specialized organizations, and other data available at the time, and involved qualitative and quantitative verification based on the status of the NMF's asset holdings, but the known risks entail uncertainties, and unknown risks and other factors are inherent, and consequently, there is no guarantee of the accuracy or safety of that information.

1.5°C Scenario

This table can be scrolled sideways.

(hundred million yen)

| <Changes in the world> | <Risk details> | <Details of opportunities/risk reduction and corresponding costs> | |||||||||

| Category | Risk | Financial impact amount | Opportunity/Response cost | Financial impact amount | |||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| 2030 | 2050 | 2030 | 2050 | ||||||||

| Policy | Introduction of carbon tax system | Transition risk | Incurrence/increase of carbon tax burden | (Single year) ▲4.7 |

(Single year) ▲8.5 |

|

Risk mitigation | Reduced burden of carbon tax due to energy saving construction and introduction of renewable energy electricity | (Single year) +3.7 |

(Single year) +6.6 |

|

| Required cost | Cost increase due to introduction of renewable energy electricity | (Single year) ▲0.3 |

(Single year) ▲0.3 |

||||||||

| Market | Increasing number of companies aiming to become carbon neutral Selection of properties with emphasis on energy creation and energy saving performance by tenants |

Declining competitiveness of properties with poor environmental performance (properties that have not obtained environmental certification) | (Single year) ▲13.0 |

(Single year) ▲13.0 |

|

Opportunity | Improving the competitiveness of properties with high environmental performance (properties with environmental certification) | (Single year) +9.4 |

(Single year) +9.4 |

||

| Risk mitigation | Restore and improve competitiveness by improving environmental performance (obtaining environmental certification) | (Single year) +4.6 |

(Single year) +4.6 |

||||||||

| Required cost | Environmental certification acquisition and maintenance costs | (Single year) ▲0.3 |

(Single year) ▲0.3 |

||||||||

| Changes in banks' lending decisions based on the Principles for Responsible Banking | Decrease in funding costs through green loans, etc. | ー(*1) | ー | ー(*1) | |||||||

| Acute | Increasing severity of natural disasters | Physical risk | Occurrence/increase in property damage due to floods and storm surges and decrease in rental income due to business suspension | (Cumulative) ▲8.0 |

(Cumulative) ▲36.2 |

|

Risk mitigation/Opportunity | Generation/increase of insurance income | (Cumulative) +8.0 |

(Cumulative) +36.2 |

|

| Increase in non-life insurance premiums | (Single year) ▲0.1 |

(Single year) ▲0.6 |

|||||||||

| Chronic | Increase in average temperature | Increase in cooling costs | (Single year) ▲0.1 |

(Single year) ▲0.1 |

Reduce heating costs | ー(*1) | |||||

| Total (①) |

(Single year) ▲18.0 (Cumulative) ▲8.0 |

(Single year) ▲22.2 (Cumulative) ▲36.2 |

Total (②) |

(Single year) +17.1 (Cumulative) +8.0 |

(Single year) +20.0 (Cumulative) +36.2 |

||||||

| Residual risk (①-②) |

(Single year) ▲0.9 (Cumulative) - |

(Single year) ▲2.2 (Cumulative) - |

|||||||||

- *1 Because the impact is minor, it is not included in the calculation.

- *2 For the prerequisites for calculating each risk, please see here.

NMF response policy

This table can be scrolled sideways.

| Category | NMF response policy and initiatives | |||

|---|---|---|---|---|

| Transition risk related | Policy | Introduction of carbon tax system | Risk mitigation/Opportunity |

Reducing carbon taxes by reducing GHG emissions ■Goal (KPI)

|

| Market | Increasing number of companies aiming to become carbon neutral Selection of properties with emphasis on energy creation and energy saving performance by tenants |

Maintaining and improving property competitiveness by improving the environmental performance of owned properties and obtaining environmental certification ■Goal (KPI)

|

||

| Changes in banks' lending decisions based on the Principles for Responsible Banking | ・Formulation of green finance framework, etc. ・Green loan borrowing, green bond issuance, etc. | |||

| Physical risk related | Acute | Increasing severity of natural disasters |

・When making a new investment: Investigation of climate change risks such as flooding risk during the due diligence process ・During property operation: Periodic sustainability risk assessment (including climate change risks such as flooding risk) ・Disaster countermeasures in terms of both hardware and software (Hardware side: waterproof version installation, road heating installation, etc.) (Intangible aspects: inland flood risk alert distribution system, BCP planning, disaster prevention training, etc.) ・Appropriate insurance against disaster risks |

|

| Chronic | Increase in average temperature | |||

4°C Scenario (reference)

This table can be scrolled sideways.

(hundred million yen)

| <Changes in the world> | <Risk details> | <Details of opportunities/risk reduction and corresponding costs> | |||||||||

| Category | Risk | Financial impact amount | Opportunity/Response cost | Financial impact amount | |||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| 2030 | 2050 | 2030 | 2050 | ||||||||

| Policy | Introduction of carbon tax system | Transition risk | Incurrence/increase of carbon tax burden | (Single year) ▲0.1 |

(Single year) ▲0.1 |

|

Risk mitigation | Reduced burden of carbon tax due to energy saving construction and introduction of renewable energy electricity | (Single year) +0.1 |

(Single year) +0.1 |

|

| Required cost | Cost increase due to introduction of renewable energy electricity | (Single year) ▲0.3 |

(Single year) ▲0.3 |

||||||||

| Market | Increasing number of companies aiming to become carbon neutral Selection of properties with emphasis on energy creation and energy saving performance by tenants |

Declining competitiveness of properties with poor environmental performance (properties that have not obtained environmental certification) | - | - |  |

Opportunity | Improving the competitiveness of properties with high environmental performance (properties with environmental certification) | - | - | ||

| Risk mitigation | Restore and improve competitiveness by improving environmental performance (obtaining environmental certification) | - | - | ||||||||

| Required cost | Environmental certification acquisition and maintenance costs | - | - | ||||||||

| Changes in banks' lending decisions based on the Principles for Responsible Banking | Decrease in funding costs through green loans, etc. | ー(*1) | ー | ー(*1) | |||||||

| Acute | Increasing severity of natural disasters | Physical risk | Occurrence/increase in property damage due to floods and storm surges and decrease in rental income due to business suspension | (Cumulative) ▲8.8 |

(Cumulative) ▲49.5 |

|

Risk mitigation/Opportunity | Generation/increase of insurance income | (Cumulative) +8.8 |

(Cumulative) +49.5 |

|

| Increase in non-life insurance premiums | (Single year) ▲0.2 |

(Single year) ▲1.1 |

|||||||||

| Chronic | Increase in average temperature | Increase in cooling costs | (Single year) ▲0.1 |

(Single year) ▲0.3 |

Reduce heating costs | ー(*1) | |||||

| Total (①) |

(Single year) ▲0.4 (Cumulative) ▲8.8 |

(Single year) ▲1.5 (Cumulative) ▲49.5 |

Total (②) |

(Single year) +0.2 (Cumulative) +8.8 |

(Single year) +0.2 (Cumulative) +49.5 |

||||||

| Residual risk (①-②) |

(Single year) ▲0.6 (Cumulative) - |

(Single year) ▲1.7 (Cumulative) - |

|||||||||

- *1 Because the impact is minor, it is not included in the calculation.

- *2 For the prerequisites for calculating each risk, please see here.

Risk Management

The risk management systems relating to sustainability of the asset management company to which NMF has entrusted operation of its assets are as set forth below.

At the time of investment decision

When making new investments in assets under management, the Investment Committee makes investment decisions in the due diligence process taking into consideration various investigations of climate change related risks. Specifically, with respect to the possibility of flooding and inundation of a target property, the inundation level and inundation history are investigated and confirmed using various hazard maps and the history of hydraulic engineering work implementation is also investigated and confirmed. In addition, the presence of environmental and energy-conserving facilities including acquisition of environmental certification, the status of business continuity planning, and other factors are confirmed.

During operation

The Sustainability Promotion Committee performs management and monitoring of overall risks relating to sustainability including climate change risks. Specifically, the status of implementation of energy-conservation measures to achieve greenhouse gas (GHG) emissions reduction targets (see (4) Metrics and Targets below for details) and the status of GHG reductions based on such implementation are monitored for each property, and this information is visualized to analyze the factors of increases or decreases in GHG emissions, and necessary countermeasures are investigated as needed. In addition, sustainability and risk assessment sheets are prepared for each property and the likelihood of climate change risks and other risks occurring is evaluated. These evaluations are conducted for a certain proportion of owned properties each year in accordance with a rotation of approximately five years for all properties. All sustainability initiatives, including climate change risk, are promoted based on the management and supervision of the Chief Executive Officer (Director) for Sustainability Promotion.

Metrics and Targets:Materiality

NMF is aware that solving environmental problems exemplified by climate change is an important management issue within its sustainable business and its business strategies for achieving sustainable business. Based on this understanding, NMF is investing in lower environmental impact buildings, taking measures to increase the efficiency of energy usage and reduce GHG emissions through the implementation of environmental and energy conservation measures at owned properties, and seeks to establish a low environmental impact portfolio.

Making owned properties greener

Key Performance Indicator

Raise the ratio of properties acquired green certification (with three stars or more or equivalent to) to 70% by 2030.

- ※Green certification (with three stars or more or equivalent to) refers to DBJ Green Building Certification (three stars or more) or BELS Certification (three stars or more), or CASBEE for Real Estate (B+ or higher)

- ※The figure is calculated based on the floor area of our properties excluding land.

- ※For actual results to KPI, please refer here.

Greenhouse Gas (GHG) Emissions

Key Performance Indicator (KPI)

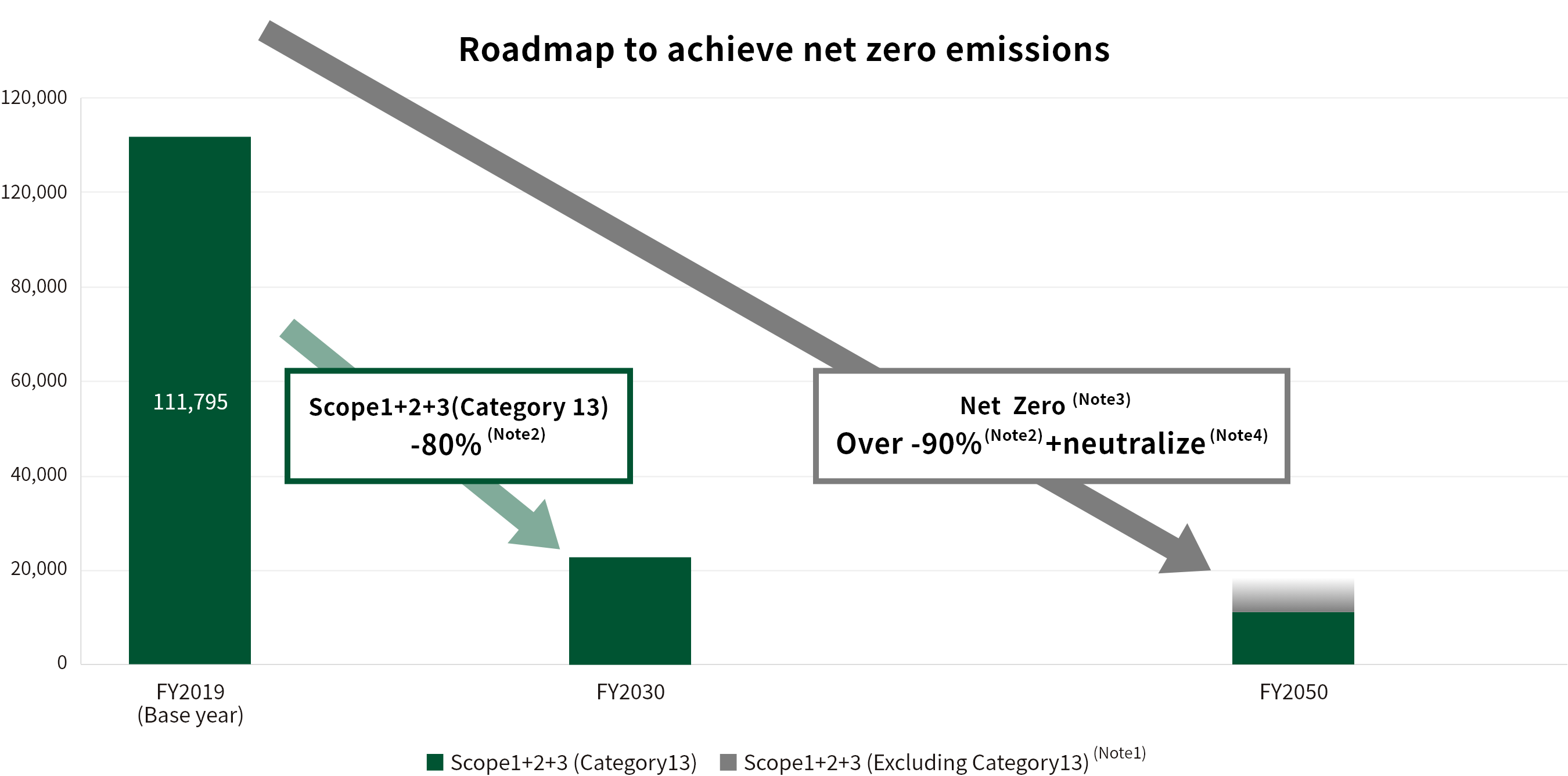

Achieve net zero greenhouse gas (GHG) emissions by 2050

Achieve 80% reduction in greenhouse gas (GHG) emissions by 2030 (compared with the 2019 level) (Category 13 (Fuel and electricity related to tenant management assets))

Water Use

Key Performance Indicator (KPI)

Achieve 10% reduction in water use per floor area (intensity) in our portfolio

Metrics and Targets:Transition Roadmap

NMF has formulated a transition roadmap to achieve net zero GHG emissions by 2050.

NMF will endeavor to reduce total Scope 1, 2, and 3 (Category 13) GHG emissions by 80% compared with the 2019 level by 2030.

For the detailed action plan, please see here.

Toward 2050, NMF will endeavor to achieve net zero Scope 1, 2, and 3 GHG emissions.

In accordance with the definition of net zero emissions referred to above, NMF will reduce its total GHG emissions by 90% compared with the 2019 level and neutralize the remaining emissions by internationally accredited methods.

| (Note 1) | The heights of the bars in the graph are roughly depicted. Although at this point NMF has not set KPIs for items other than Scope 3 Category 13 items, NMF will work on reduction of emissions for other items. |

|---|---|

| (Note 2) | The FY2019 results are used as the base year. |

| (Note 3) | The achievement of net zero emissions for items other than Scope 3 Category 13 items will been set as KPIs. |

| (Note 4) | In accordance with the definition of net zero emissions, NMF will neutralize the remaining emissions by internationally accredited methods. |