Compliance

Basic Policy on Compliance

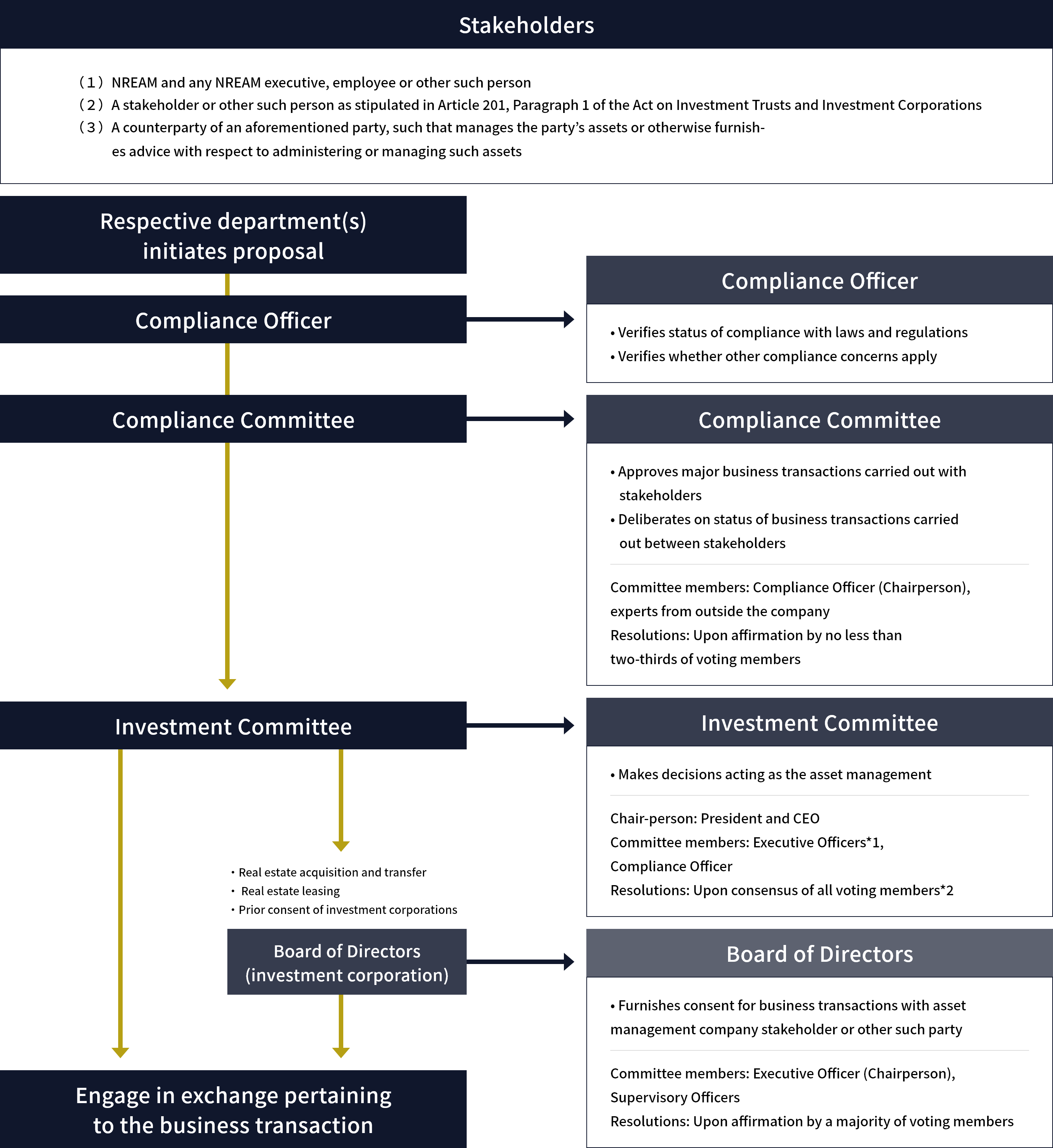

The Asset Management Company, under the basic recognition that the management operations of NMF’s assets comprise the management of the capital of NMF’s unitholders, believes that confirming the status of compliance with laws, and sufficiently securing the elimination, etc., of conflicts of interest in transactions with stakeholders, etc., as stipulated in the Act on Investment Trusts and Investment Corporations, and with transactions, etc., where stakeholders, etc., manage the assets or offer advice relating to management or operations, is particularly important in protecting unitholder’s profits and securing the trust of unitholders. From this perspective, the Asset Management Company has established the following structure regarding compliance, and has made sufficient considerations to ensure that this gets consistently implemented.

Compliance Structure

Board of Directors

The Board of Directors strives to achieve and ensure compliance by establishing the system necessary for compliance, formulating a compliance manual, and promoting its implementation.

Compliance Committee

The Compliance Committee has been established as an organ to confirm the status of compliance with laws and regulations and to deliberate upon transactions, etc., with stakeholders, etc.

One lawyer and one professor in graduate school have been appointed to the Compliance Committee and attend meetings as external committee members. Both are third parties that do not have conflicts of interest with the Investment Corporation or with sponsor company groups. Because there is a system of checks by independent third parties which is well suited for compliance, we believe that this secures the effectiveness of observing compliance.

Please see the following for constituents and frequency of meetings of the Compliance Committee. (link for the corporate governance page)

Legal & Compliance Department and Compliance Officer

In order to establish an appropriate management structure and to conduct business with clients honestly and fairly by securing the optimization of tasks in Type II Financial Instruments Business, etc., an internal system of checks-and-balances has been secured through the establishment of the Legal & Compliance Department as the department in charge of compliance.

Moreover, the head of the Legal & Compliance Department will be the Compliance Officer, the person in charge of compliance, and will constantly monitor the Asset Management Company’s conduct of affairs to ensure that these are being conducted based on laws and regulations. For this reason, the Compliance Officer must ensure that all proposals drafted by the Investment Committee observe laws and regulations and that there are no problems in terms of other compliance issues. In addition, the Compliance Officer will attend meetings held by the Investment Committee (decision-making organ), which is the committee which decides management policies, etc., for each fund, etc. Here they can state their opinion on the situation of compliance in terms of the deliberative process and conclusions for all proposals drafted by the Investment Committee. However, the Compliance Officer does not have the right to vote at the Investment Committee in order to maintain neutrality when it comes to decision-making (this includes cases where the Compliance Officer is also the Executive Director).

(Note) NREAM is contracted for asset management and investment advice for multiple investment corporations (NMF and Nomura Real Estate Private REIT, Inc.) and other real estate funds, etc. (these include special purpose companies and corporations or associations of other structures which are vehicles for investments, settlor companies of investment trusts, and trustees, etc., but are not limited to these.). These multiple investment corporations and other real estate funds, etc., will be called “funds, etc.”

Decision-Making Process for Investment Management and Prevention of Conflict of Interest in Transactions

At Investment Committee meetings, the Asset Management Company is responsible for deliberating on basic policies related to operating the assets of the Investment Corporation, operation management policies related to assets, and policies regarding important matters such as finance. In addition, the Asset Management Company also deliberates on acquisition or sale of assets based on relevant policies, operation management, and important matters related to operating the assets of the Investment Corporation such as funds procurement, and conducts decision making as the asset management company.

All proposals to be submitted to the Investment Committee are to be screened by the Compliance Officer for violations and conflict with laws and regulations and if they violate any other compliance issues. When a proposal is deemed an “important transaction with stakeholder,” as internally defined by the Rules Concerning Transactions with Related Parties, or when it is deemed necessary in view of other details, a Compliance Committee meeting is called and further deliberation is conducted upon the observance of laws and regulations and violation of other compliance issues. Unless proposals have gained approval through this process, they cannot be proposed at the Investment Committee.

Furthermore, subsequent to approval by the Board of Directors of the Asset Management Company, approval from the Investment Corporation’s Board of Directors is required prior to a transaction involving the acquisition, disposition or lending of securities or real estate between the Investment Corporation and a related party (as defined in Article 201-1 of the Investment Trust Act) of the Asset Management Company, except certain transactions determined not to have a significant impact on each investment corporation under the Ordinance for Enforcement of the Act on Investment Trusts and Investment Corporations.

The Board of Directors has determined that transactions with a related party shall always be conducted fairly based on market prices.

Establishment and Execution of Compliance Manual

Nomura Real Estate Group Code of Action has set the basic standards that all executives and staff of the Group should observe. With the purpose of actualizing the Nomura Real Estate Group Code of Ethics, a Compliance Manual was established which indicates governing laws and regulations (Financial Instruments and Exchange Act, Act on Investment Trusts and Investment Corporations, etc.) that all executives and staff should observe, basic policies and the roles of each organization in executing compliance, and operational procedures for executives and staff.

Based on this Compliance Manual, a Compliance Program is drawn up each fiscal year as a basic rule as a detailed plan to realize compliance, and thorough compliance with laws are aimed for through executing compliance training.

Compliance Training, Education

In order to observe compliance and cultivate awareness, the Asset Management Company conducts regular compliance training (every month) for all employees,(including contract employees, etc.), mainly outlining basic policies of compliance and thorough observance standards ensuring that employees master laws and regulations that must be observed. Moreover, individual training for new employees and for those departments that have special characteristics are also conducted. Moreover, training is also conducted throughout the year based on the Compliance Program set by Nomura Real Estate Group.

This table can be scrolled sideways.

| Month | Training Session Theme | Attendance Rate |

|---|---|---|

| Mar-24 | This year's summary | 100.0% |

| Apr-24 | Fiscal 2024 Compliance Activity Plan(From the 2024 compliance program) | 100.0% |

| May-24 | Conflict of Interest Management System | 100.0% |

| Jun-24 | Information management : Consignment of handling of important information | 100.0% |

| Jul-24 | Confirmation of understanding and penetration of principle-based compliance | 100.0% |

| Aug-24 | Efforts to eliminate anti-social forces | 100.0% |

| Sep-24 | Toward the establishment of a compliance and risk management system | 100.0% |

| Oct-24 | Principle-based approach | 100.0% |

| Oct-24 | Lessons from attempted money transfer fraud case | 100.0% |

| Nov-24 | Contractor responsibility | 100.0% |

| Dec-24 | Insider trading regulations | 100.0% |

| Jan-25 | AML/CFT management system | 100.0% |

| Feb-25 | Key observations from securities inspections and such on financial instruments business operators | 100.0% |

Please see the following for theinitiatives to raise awareness for the compliance by Nomura Real Estate Group. (link)

Response to Compliance Violations

The Asset Management Company has developed the Information Communication Guidelines which describe in-house structures and specific procedures so that if a risk occurs that should be managed by the Asset Management Company, such as a compliance violation, information regarding the case that has occurred can be communicated quickly and accurately.

Based on the Guidelines and other various regulations on compliance, the Compliance Officer (Head of the Legal & Compliance Department) who receives the information regarding a case that has occurred asks relevant departments, etc. to investigate and report on the causes of the case and measures to be taken, considers the materiality of the case, and if necessary, reports and offers an opinion to the Director and President and asks for appropriate measures to be taken.

With regard to improper behavior or behavior that may be considered improper from the standpoint of compliance, if determined necessary by the Compliance Officer, responses to improper behavior or behavior that may be considered improper are deliberated on by the Compliance Committee.

Responding to Antisocial Forces

The Asset Management Company will observe the Code of Ethics implemented by Nomura Real Estate Group, of which it is a part, and its basic policy is to cut all relations with antisocial forces. In addition, the Asset Management Company has established its own “Basic Policies against Antisocial Forces” which takes into consideration “Guideline for How Companies Prevent Damage from Anti-Social Forces (Government policy)” and the “Comprehensive Guidelines for Supervision of Financial Instruments Business Operators,” and will deal with antisocial forces with a resolute attitude to cut any relations with them.

In addition to constructing and executing a screening structure to identify antisocial forces during transactions by partnering with Nomura Real Estate Holdings, Inc., we will also execute specific initiatives looking at cutting relations with antisocial forces through implementing articles excluding organized crime from agreements with clients and by ensuring thorough examination when making transactions under the Act on Prevention of Transfer of Criminal Proceeds.

We thoroughly implement the above efforts even when dealing with outsourced companies, intermediaries, etc. at asset management companies.

Preventing Bribery, Corruption

The Asset Management Company will observe the Code of Ethics implemented by Nomura Real Estate Group, of which it is a part, and works towards preventing bribery when entertaining clients or giving gifts.

Specifically, the Group Code of Action provides, with regard to receipt or provision of entertainment or gifts from or to business partners, "Nomura Real Estate Group officers and employees shall not request, provide, or receive entertainment or gifts incompatible with sound business practices or common sense" and "No officer or employee shall use their professional position to request or accept benefits or favors from a business partner." The Group strictly implements the Code of Conduct, for instance, detailed reporting and documentation of the details of entertainment or goods provided or received by its officers and employees.

Moreover, with a high regard for the “Guideline to Prevent Bribery of Foreign Public Officials,” formulated by the Ministry of Economy, Trade and Industry, a “Basic Policy on Preventing Bribery of Foreign Public Officials” and has been established and released on its website. Under the same policy, the Asset Management Company has also established “Regulations on Preventing Bribery of Foreign Public Officials” and “Guidelines on Preventing Bribery,” and conducts specific internal processes when dealing with foreign officials such as entertaining, giving gifts, inviting, donating, and utilizing their agencies, etc.

In addition, the Compliance Department regularly monitors the status of entertainment and gifts given to officers and employees (once every six months).

We aim to distribute this knowledge to executives and employees by conducting regular training regarding bribery prevention for executives and employees in Nomura Real Estate Group’s foreign business departments and by incorporating it into the training material for the monthly Compliance Training conducted by the Asset Management Company.

In fiscal 2019, there were no significant legal violations, fines or penalties related to corruption or bribery.