Governance of the Investment Corporation

Governance of NMF

The organization of the Investment Corporation consists of the General Meeting of Unitholders which is composed of unitholders, one Executive Director, three Supervisory Directors, the Board of Directors* whose members include Executive Directors and Supervisory Directors, and an Independent Auditor. The Investment Corporation’s Independent Auditor is Ernst & Young ShinNihon LLC.

- ※Based on the Act on Investment Trusts and Investment Corporations and the Investment Corporation’s Articles of Incorporation, the number of supervisory directors must be the number of executive directors plus 1 or more.

- ※Although NMF has a Board of Directors comprised of an executive director and supervisory directors, it is required that operations are outsourced as the use of employees is prohibited under law.

For details on the above organization, see the latest Securities Report, “Part 1. Fund Information / Section 1. Status of the Fund / 1. Overview of the Investment Corporation / (4) Structure of the Fund”. Only available in Japanese.

Executive Director and Supervisory Directors

The status and term of office for the executive director and the supervisory directors

The Executive Director has authority to execute NMF’s business and perform any and all acts in or out of court regarding the NMF’s business on behalf of NMF.

Supervisory Directors have authority to supervise the Executive Director’s execution of duties.

At Board of Directors meetings of NMF, each Supervisory Director receives a report from the Executive Director on the status of business execution, the status of asset management by the Asset Management Company and matters regarding compliance and risks and, if necessary, the Executive Director is asked to attend the Board of Directors meeting to report those matters.

See About NMF/Corporate Profile/Director information.

The term of office has been set as two years in the Articles of Incorporation for both the executive director and the supervisory directors.

Criteria for Electing Executive Director and Supervisory Director

Candidates for directors are elected provided there are no causes for disqualification as stipulated in the Act on Investment Trusts and Investment Corporations (ITA) and other laws and regulations (Articles 98 and 100 of the ITA and Article 244 of Ordinance for Enforcement of the ITA). Moreover, they are appointed under the following reasons upon the passing of a resolution at the General Meeting of Unitholders. The current directors are all external experts (lawyers, accountant, real estate appraiser) who have no special interests in the Investment Corporation.

This table can be scrolled sideways.

| Title | Name | Reasons for election | Gender | Attendance at Board of Directors meetings (FY2024) |

|---|---|---|---|---|

| Executive Director |

Shuhei Yoshida |

Mr. Yoshida was the Supervisory Director of the former Nomura Real Estate Master Fund, Inc. and NMF, and is an attorney. As such, he is an expert in the ITA and related laws and regulations, specializing in the newest laws and regulations for real estate, particularly land and building leases, fixed-term land lease holdings, fixed-term house rentals, and lifetime leases. Upon considering his abundant experience, Mr. Yoshida was selected as Executive Director as it was determined that he has sufficient knowledge and experience for the position and to exercise his right to represent NMF. | Male | 100% (11 times/ 11 times) |

| Supervisory Director |

Mineo Uchiyama |

As a certified public accountant, Mr. Uchiyama is well versed in accounting and tax matters. He also has experience auditing the accounts of companies listed on the Tokyo Stock Exchange, and has supervised the Executive Director’s tasks as a Supervisory Director for NMF. Mr. Uchiyama was selected as a Supervisory Director as it was determined that he has sufficient knowledge and experience to conduct the work required as a member of the Board of Directors for NMF. | Male | 100% (11 times/ 11 times) |

| Supervisory Director |

Mika Okada (Note1) |

As a lawyer, Ms. Okada is well versed in various related laws and regulations including real estate transactions. She was selected as a Supervisory Director as it was determined that she has sufficient knowledge and experience to supervise the Executive Director’s tasks as a Supervisory Director for NMF and to conduct the work required as a member of the Board of Directors for NMF. | Female | 100% (11 times/ 11 times) |

| Supervisory Director |

Toko Koyama |

As a real estate auditor, Mr. Owada possesses vast insight regarding the fairness and transparency of real estate transactions. He has also had experience as Director, etc., at multiple corporations and has supervised the Executive Director’s tasks as a Supervisory Director for NMF. Mr. Owada was selected as a Supervisory Director as it was determined that he has sufficient knowledge and experience to conduct the work required as a member of the Board of Directors for NMF. | Female | 100% (11 times/ 11 times) |

- (Note 1) Concerning Ms. Okada, the name described above is the former and professional name, but the name on the family register is Mika Furusawa. In addition, her term of office has started from June 1, 2019.

Director Equity Policy

Directors of NMF may not buy or sell investment units of NMF in order to prevent insider trading as stipulated in the Insider Trading Management Regulations.

Administration Fees, etc.

Administration fees the Investment Corporation pays are as follows:

Compensation for Executive Directors and Supervisory Directors

Compensation for an executive director shall be no more than 800,000 yen per month, while compensation for a supervisory director shall be no more than 700,000 yen per month. The amount of compensation shall be determined by the Board of Directors, taking into account the levels of compensation of directors and statutory auditors performing similar work in similar positions for other companies and legal entities, general economic trends, trends concerning wages and other factors.

For total amounts of compensation by operation period, see the Asset Management Report, “Overview of the Investment Corporation, (3) Matters Concerning Directors, etc.” Only available in Japanese.

This table can be scrolled sideways.

| Title | Name | Total compensation amount (FY2024) |

|---|---|---|

| Executive Director | Shuhei Yoshida | 4,800 thousand yen |

| Supervisory Director | Mineo Uchiyama | 3,600 thousand yen |

| Supervisory Director | Mika Okada | 3,600 thousand yen |

| Supervisory Director | Toko Koyama | 3,600 thousand yen |

Compensation for Independent Auditor

The compensation amount to the independent auditor for each fiscal period subject to audit shall be determined by the Board of Directors within a maximum amount of 30 million yen. For total amounts of compensation by operation period, see the Asset Management Report, “Overview of the Investment Corporation, (3) Matters Concerning Directors, etc.” Only available in Japanese.

This table can be scrolled sideways.

| Title | Name | Total compensation amount (FY2024) |

|---|---|---|

| Independent Auditor | Ernst & Young ShinNihon LLC | 58,000 thousand yen |

- (Note1)Executive directors, supervisory directors or independent auditors (here and hereafter in this Article, referred to as the “Directors Etc.”) are liable for damages to NMF if they have neglected to perform their duties. However, if Directors, Etc., have performed their duties in good faith and without gross negligence, and when NMF finds it particularly necessary, taking into consideration the details of the facts that are the source of liability, the status of the execution of the duties of such Directors Etc., and other circumstances, NMF may, to the extent permitted by laws and regulations, by resolution of the Board of Directors, exempt such Directors Etc., from liability for damages under the Act on Investment Trusts and Investment Corporations and the Investment Corporation’s Articles of Incorporation.

- (Note2)Of the remuneration paid to the Independent Auditor, ¥49 million was for Accounting adit and ¥3 million was for preparing a comfort letter(non-Audit)

Compensation for the Asset Management Company

Compensations for the Asset Management Company are comprised of Management Fees, Acquisition Fees, and Disposition Fees, and are decided by the following calculation method determined in the Investment Corporation’s Articles of Incorporation.

As for the compensation structure for the Asset Management Company, a system (Management Fee II) has been implemented to increase or decrease compensation based on the amount of profits for the Investment Corporation. It is thought that this will strengthen the asset management company’s sense of commitment in terms property management, such as increasing rents and cutting appropriate costs, and funds procurement, such as negotiating decreases in financing conditionality with lenders.

With the implementation of this compensation system, the linkage with net income will rise, and it is thought that this will contribute to further increases in unitholder value.

For total amounts of compensation for each position by operation period, see the Asset Management Report, “Conditions of Costs and Liabilities, (1) Details of Costs for Operations, etc.” Only available in Japanese.

This table can be scrolled sideways.

| Fee structure | Calculation method |

|---|---|

| Asset management feeⅠ(Total assets-linked) | Total assets (*1) × 0.45%(annual basis) |

| Asset management fee II(Net income-linked) | Net income (*2) × 5.5% |

| Acquisition fee | Acquisition Price × 1.0% |

| Disposition fee | Disposition Price × 1.0% |

- (*1)Excludes unamortized goodwill.

- (*The amount obtained by adding goodwill amortization cost to Net Income before Deduction of Management Fee II and deducting gain on negative goodwill, after compensation of loss carried forward (if any).

For details on the above compensation for management and compensation for management, etc., of other asset custody companies, general administrative agents (administration, accounting), and administrator of the investors' registries, see the latest Securities Report, “Part 1. Fund Information / Section 1. Status of the Fund / 4. Commissions, etc., and Taxes.” Only available in Japanese.

Management Structure of NMF

NMF has appointed Nomura Real Estate Asset Management Co., Ltd. (NREAM), to perform all asset management services for NMF. NREAM manages NMF’s assets in accordance with the Asset Management Agreement conducted between NMF and NREAM.

NREAM is entrusted with the management of assets of multiple investment corporations including NMF and other real estate funds in addition to offering advice on investments.

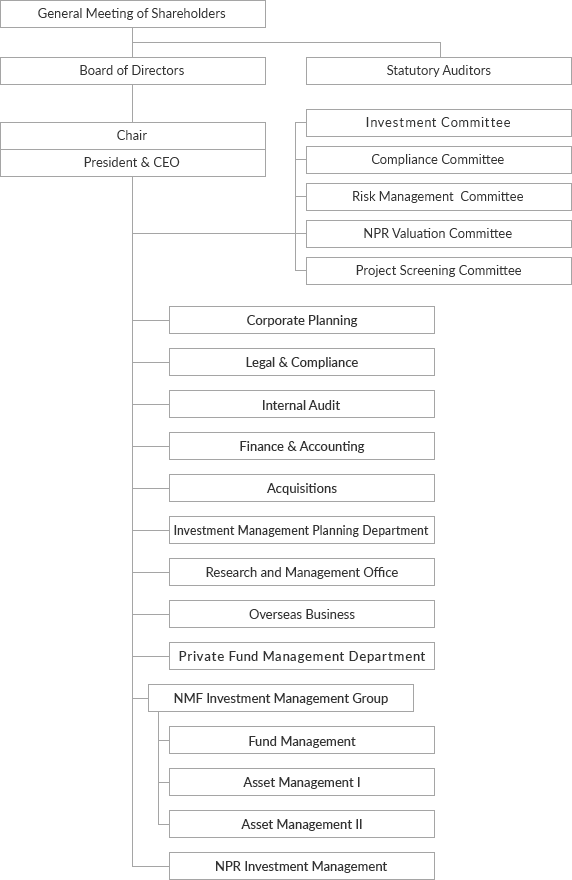

<Overview of Each Committee>

This table can be scrolled sideways.

| Name of Committee | Overview | |

|---|---|---|

| Investment Committee |

|

|

| Constituents |

Chair:President and Executive Officer Members:Executive Officers, Compliance Officer, and any other person appointed by the chair. (Note) Excluding Head of Fund or Head of each department of NMF Investment Management Group and part-time Executive Officer |

|

| Frequency of meetings |

As a basic rule, the chair calls a meeting once a week. However, a meeting can be held immediately if needed. |

|

| Compliance Committee |

|

|

| Constituents |

Chair:Compliance Officer Members:outside experts appointed by the chair |

|

| Frequency of meetings |

As a basic rule, the chair calls a meeting once every three months. However, a meeting can be held immediately if needed. |

|

| Risk Management Committee |

|

|

| Constituents |

Chair:Executive Officer in charge of Legal & Compliance Department Chair:Executive Officer in charge of Legal & Compliance Department Members: Vice President and Executive Officer, Senior Managing Executive Officer, and Managing Executive Officer |

|

| Frequency of meetings |

The chair calls a meeting at least once every three months. However, a meeting can be held immediately if needed. |

|

| Project Screening Committee |

|

|

| Constituents | General manager of the Acquisition Department, managers of business units operating under that department, and the fund managers of each operating funds. | |

For details regarding the management structure of the asset management company, see the Securities Report’s “Part 2. Detailed Information of the Investment Corporation / Section 4. Status of Related Corporations / 1. Conditions of the Asset Management Company.” Only available in